Daily Briefing 3/7/25

Establishment Survey Payrolls/Hours Worked (CES)

The February 2025 employment report from the BLS showed that total nonfarm payrolls increased by 151,000, with the unemployment rate holding steady at 4.1 percent. Average hourly earnings increased by only 0.3%, resulting in a 4.0% rise year-over-year. However, wage growth has remained below prior benchmarks since September 2023, indicating a deceleration in the pace of increases. The average workweek remained at 34.1 hours for the second straight month, the smallest since March 2020. Total hours only increased by 0.1% following declines in December and January.

Interpretation

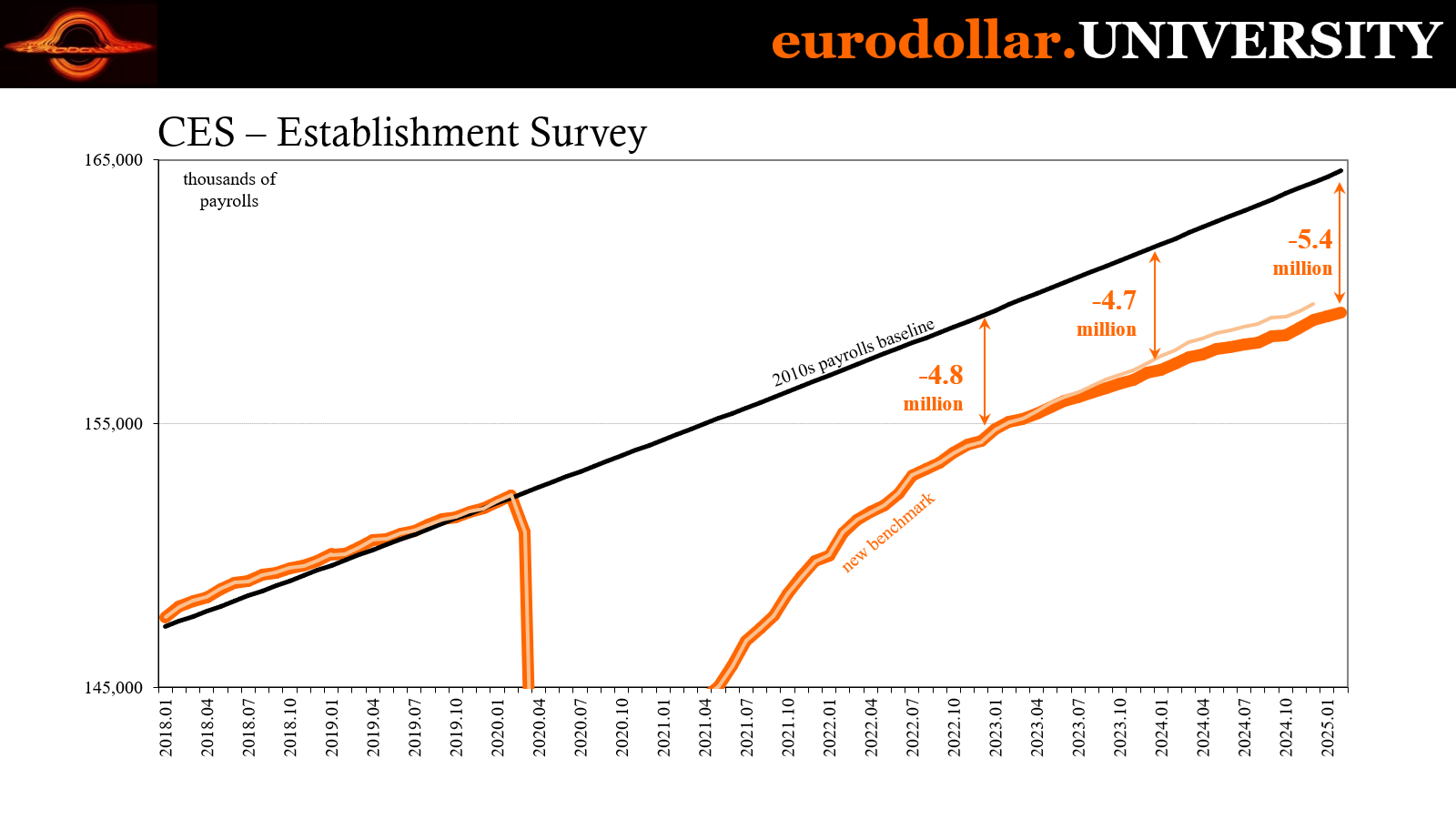

Despite the headline employment gains, deeper analysis suggests a weaker labor market than the official figures indicate. Payroll data has been increasingly unreliable due to trend-cycle adjustments that tend to overstate employment growth, yet even now it has slowed back down to start 2025 and that is already consistent with the artificial highs seen in a wide cross section of data. At the very least, CES is also picking up the loss of momentum heading further into the year, if downplaying the downturn as is its usual pattern.

However, another aspect of payroll data that does not fully reflect reality becomes evident when analyzing employment by sector. For instance, employment in the health sector increased by 52,000, while transportation and warehousing continued to expand, particularly in couriers and air transportation. However, a concerning trend emerges as industries typically resilient in a growing economy - such as mining, construction, manufacturing, and professional services – each showed little change.

This cooling economy, and the fact that it has not truly recovered from the pandemic crisis, is also reflected in wage growth. In February, average hourly earnings rose by only 0.3%, marking a 4.0% increase year-over-year. However, since September 2023, wage growth has remained below prior benchmarks, indicating that incomes are on a downward trend.

The greatest concern is the average workweek. Sticking at 34.1 hours, that matched January at a level similar to that seen during the pandemic crisis, firmly in recession territory. This is often a sign of employers scaling back, cutting costs by lowering hours for their employees (however many the CES wishes to estimate of them). In a genuinely strong labor market, firms would not only be hiring but also increasing hours to meet rising demand. The fact that this is not happening contradicts the impression created by payroll numbers, which may be artificially inflated by trend-cycle adjustments that assume continued growth unless a full-blown recession is underway.

Moreover, the payroll data still falls significantly short of pre-pandemic employment levels, with over five million jobs (!) missing from a full recovery. This reality contrasts sharply with media narratives and Federal Reserve Chairman Jay Powell’s messaging, which often emphasize strength in the labor market the data doesn’t really show.

Instead, the declining workweek and sluggish wage growth point to a struggling economy rather than a robust one, a labor market that is showing more signs of deterioration even on the CES side.