WHAT’S IN A (THE) DOLLAR?

EDU DDA May 15, 2024

Summary: Why doesn’t anyone monitor money? The short but truthful answer is practically no one really knows where to begin. How can this possibly be? The recent misadventure of White House Economics advisor Jared Bernstein is actually a good illustration of where the current state of knowledge stands. Surprising to most, Bernstein was far closer to the truth than any mainstream Economists or the throngs on social media who mocked him. We’ve got Minsky, Friedman base money, ghosts, MMT and, of course, the eurodollar perspective.

A couple weeks ago, President Biden’s top economic advisor, Jared Bernstein, was widely pilloried for his rambling, confused answer to what was or what seemed a pretty basic question. His response spread immediately across social media for what become obvious reasons once you see the video or just read the text of it (some is included below).

When asked by a documentary crew why the government borrows at all since it “prints” its own “money”, the Chair of the White House Council of Economic Advisers struggled to come up with a reply:

Again, some of this stuff gets – some of the language and concepts are just confusing. The government definitely prints money, and it definitely lends that money by selling bonds. Is that what they do? They sell bonds, yeah, they sell bonds. Right? Since they sell bonds, and people buy the bonds, and lend them the money.

What Bernstein was really trying do was regurgitate something he had heard from MMT proponents. In that respect, poor Jared was actually somewhat close to their ideas:

A lot of times, at least to my ear with MMT, the language and the concepts can be kind of unnecessarily confusing but there is no question that the government prints money and then it uses that money to um, uh...I guess I'm just, I can't really, I don't get it, I don't know what they're talking about…It's like, the government clearly prints money, it does it all the time, and it clearly borrows, otherwise you wouldn't be having this debt and deficit conversation. So I don't think there's anything confusing there.

It only got worse from there. According to this virulent strain of MMT, there shouldn’t be any borrowing at all and the only reason it takes place is to placate the rich and the institutional financial classes (yes, there is an unhealthy dose of Modern Marxianism in the Theory). Bernstern clumsily tried to make that point and in the end only made it worse.

The thing is, the MMTers are far closer to being correct about money than every other mainstream Economist (save a very small few). That’s what is so alarming. Like Marxism, most people don’t bother to listen to the arguments and simply dismiss them out of hand because they don’t sound like they’re “supposed to”, what we are all taught.

Without going too deep into their theories whose sole aim is only to justify socialist takeover of the economy, when it comes to government funding MMT gets it right. Treasury doesn’t borrow from savers as most people imagine, instead it spends without regard to taxes and revenue knowing full well that in pure monetary terms it will be credited by either the Federal Reserve (down the line) or some commercial bank.

Money is created out of thin air by the stroke of the bookkeeper’s pen (though the big questions remain surrounding which bookkeeper). MMT asks only that the world give up its former pretense and then use this power for what they claim will be just and equitable purposes (said every hardcore leftist ever).

This is why some people wonder if Eurodollar University shares some root with MMT, a comparison that’s difficult to avoid however unsavory and uncomfortable. Widely considered the father of MMT, L. Randall Wray studied under Hyman Minsky. Where Minsky today is generally regarded for his work on the apparent stability of financial systems actually breeding catastrophic instability, before getting to that point he had correctly deciphered the coming ledger money revolution.

That work was never widely accepted. In January 2015, for example, Wray wrote:

These manuscripts demonstrate that in his early career Minsky had already developed a deep understanding of the nature of banking. In some respects, these unpublished pieces are better than his published work from that period (or even later periods) because he had stripped away some institutional details to focus more directly on the fundamentals. It will be clear from what follows that Minsky’s approach deviated substantially from the postwar “Keynesian” and “monetarist” viewpoints that started from a “deposit multiplier.”

It's the same shortfall in monetary scholarship I widely decry at every opportunity. The Keynesians proceed from a “government money” basis, or base money, and even the Friedman-ite monetarists do the same – which is strange for the latter given Friedman’s own efforts in contemporarily examining the emerging eurodollar system (more on that in moment).

They proceed from the basic fractional multiplication that everyone is taught in grade school (at least I’m assuming that’s what they still teach but I could be wrong and they don’t bother to teach anything nowadays). Someone deposits government money with a bank and is given safekeeping in the bank’s vault in exchange for a claim on that money which also gives the bank rights to reuse the currency or coin.

In making loans, the bank creates deposit money by creating competing claims on the same quantity of this base government money.

From that view, the supply of base money is of major importance. To the monetarists under Friedman, the concept “high powered money” is central as is therefore the central bank. Put more base money in bank vaults, deposit claims should rise and multiply (oversimplifying).

More than sixty years ago, Minsky knew this was already outdated. Banks had outgrown the need for any base money. This was the basic format of the reserveless ledger system the eurodollar “perfected”; the term reserveless simply means there is no base money only virtual bank money.

Here’s Wray in 2015 quoting Minsky from 1960:

A commercial bank lends by crediting the borrower with a demand deposit and it invests either by crediting the seller of the security with a demand deposit or by writing a check on itself in favor of the seller of the security. The bank expects that the borrower or the seller of the security credited with a deposit will use their deposit very soon after it is created. This will result in checks being drawn on the initiating bank.

In a banking system with many banks, such as the American Banking System, the expectation is that the checks drawn on any particular bank will be deposited in another bank. The bank upon which the check is drawn must pay the bank in which the check is deposited the face amount of the check. This payment takes place by transferring reserves or banker’s money. In an active trading community offsetting claims for payments arise among the banks. Bankers are sophisticated enough to set up a clearing arrangement so that only the difference between payments from a bank and payments to a bank are made in the form of reserve money. (if a check drawn upon a bank is deposited in the same bank, the entire transaction is internal to the bank: the writer’s account is decreased and the depositor’s account is increased.)

Therefore, the only use for the Federal Reserve’s bank reserves are: 1. In meeting the legal threshold of reserve requirements; and 2. A small amount only what is necessary to settle any net imbalances in payment demands between banks.

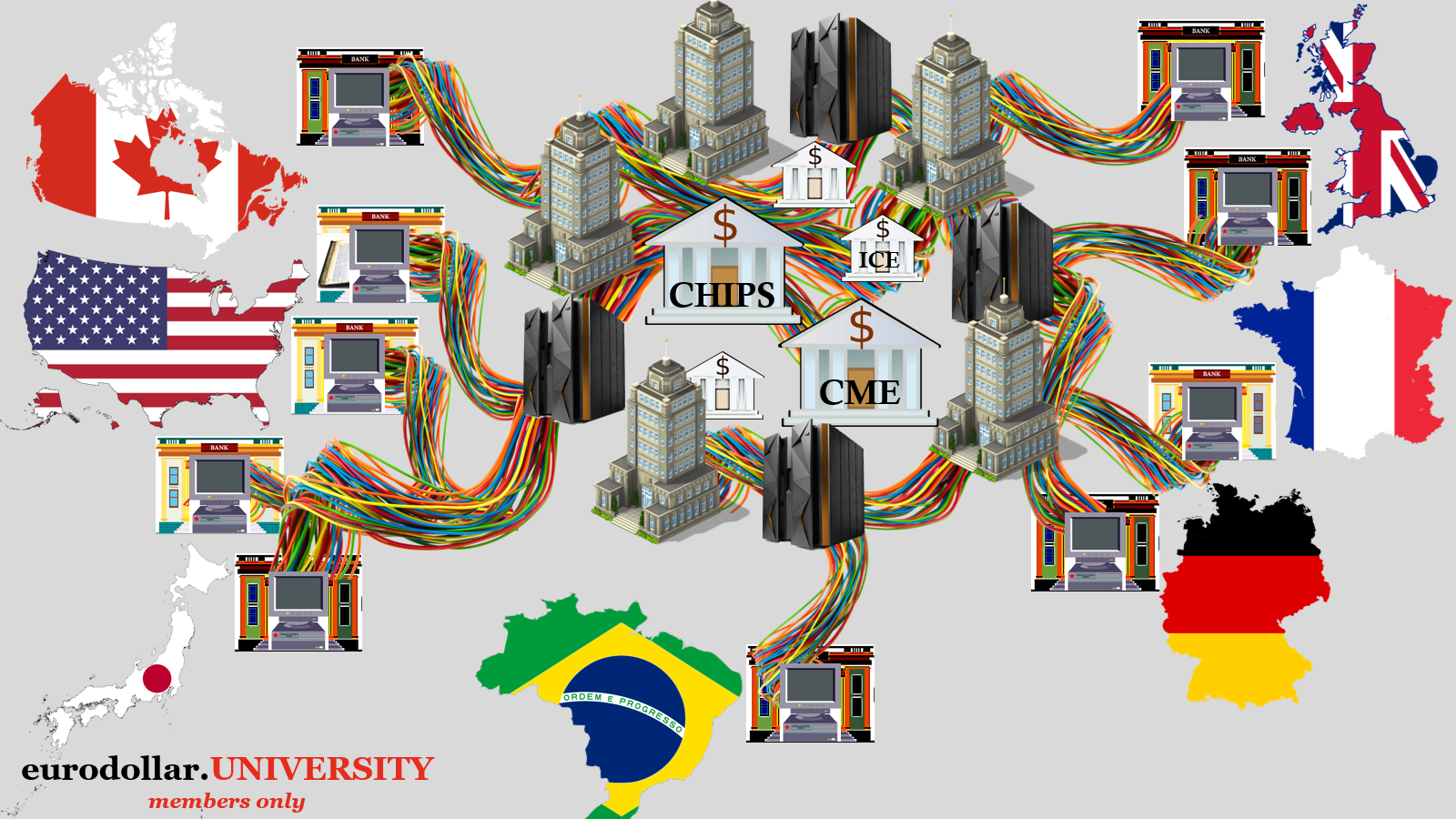

Yet, as Minsky starts to get at in the final thought above, they don’t even need the Fed and its reserves. While he uses the example of two checks drawn on a single bank which then becomes an easy internal matter of entering offsetting entries on the bank’s ledger, the same is true among the maze of global eurodollar participants.

More often, they only require to settle in correspondent balances held at a common third party, whether some clearinghouse or on the books of a clearing bank (such as triparty repo). It’s all the same, no physical cash, no Fed bank reserves required. Just a common set of standards like formatted messages and rules.

Just reading this one passage from Minsky you might already see why some who have been exposed to both MMT and Eurodollar University claim such similarities. Understanding the bank-centered, ledger nature of “modern” money is, however, where the similarities end (to be clear, I don’t believe MMT gets it complete “right” about the technical matters, either).

And I use the scare quotes around “modern” quite purposefully because the concept of ledger money is centuries old (perhaps older) as is the reserveless structure. Below is from one of my all-time favorite papers (and, of course, little-known) coincidentally also published in 2015:

Aided by the adoption of new bookkeeping practices such as ledgers with current accounts, this convention spread throughout the entire area from the 14th century onwards. Ghost money eliminated most of the problems associated with paying cash by enabling people to settle transactions in a fictional currency accepted by everyone. As a result two functions of money, standard of value and means of settlement, penetrated easily, leaving the third one, store of wealth, to whatever gold and silver coins available.

What the eurodollar system did was in realizing the inherent instability (something Minsky clearly recognized) in a true fractional reserved system, banks merely removed what they perceived as that flaw, ditching “base money” entirely leaving it as nothing more than niche to service whatever traditional needs from an ever-modernizing commercial customer base moving quickly in the same lightning-speed virtual money direction as they were going.

Even Friedman noted this facet of the system, writing in 1969 (reprinted later):

Euro-dollar deposits like “Chicago deposits” are in principle obligations to pay literal dollars — i.e., currency (or coin), all of which consists, at present, of government-issued fiat (Federal Reserve notes, U.S. notes, a few other similar issues, and fractional coinage). In practice, even Chicago banks are called on to discharge only an insignificant part of their deposit obligations by paying out currency. Eurodollar banks are called on to discharge a negligible part in this form. Deposit obligations are typically discharged by providing a credit or deposit at another bank — as when you draw a check on your bank which the recipient “deposits” in his…For Euro-dollar banks, the amount of literal cash they hold is negligible. [emphasis added]

If you are or become a Eurodollar University member, you’ll see this very same quote at the start of every one of our Classroom Videos reminding us all about this virtual money aspect.

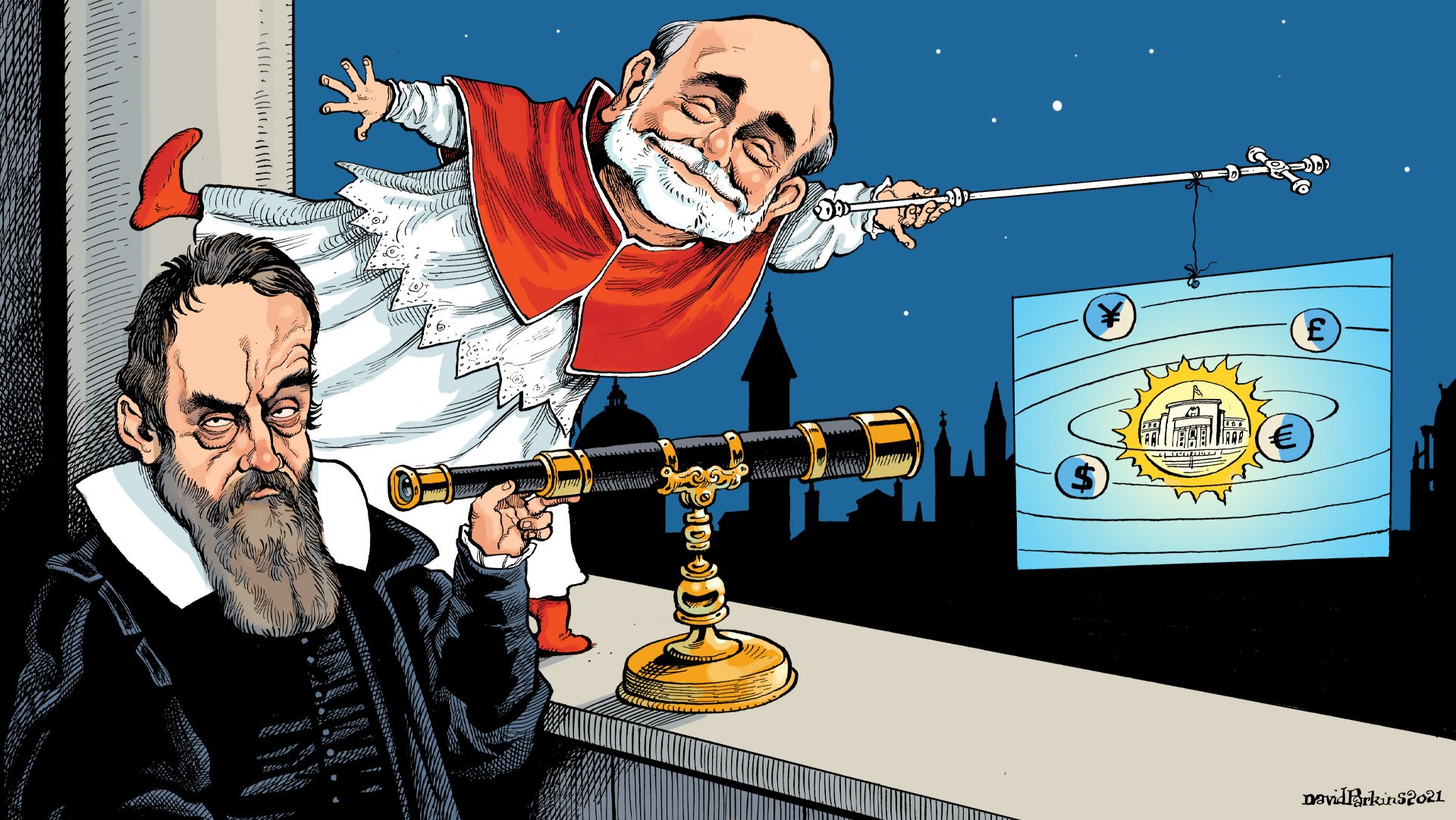

Where the Keynesians are stuck in the ancient world of a fractional reserve model, the monetarists get the ledger yet frustratingly still assign central “value” to the Federal Reserve. In other words, while Friedman noted there was no physical cash, his diagrams of the eurodollar system’s workings intentionally remained tied to American banks and their access to the Fed’s bank reserves.

He had to do this because otherwise the entire concept of “high powered money”, the role now given exclusively to central bank reserves, was rendered moot. In my own view, it seems an intentional oversight rather than being made by way of honest scientific observation. Friedman even clung to the notion well into his later years, famously urging the Bank of Japan to “print” tons of “high powered money” in the form of bank reserves in the late nineties (what would later become QE).

As we know, they did and it failed spectacularly. Today’s bank balance sheet operations aren’t the same as a vault needing base money cash or some equivalent.

For all these reasons, monetary understanding is truly non-existent across the mainstream. It is entirely understandable why this is, though thoroughly regrettable all the same. From the context of yesterday’s DDA, connecting inflation and price changes (where possible, meaning in cases other than supply shocks) to real world money mechanics might be possible but no one knows where to even begin.

The Keynesians are still searching bank vaults for various forms of government cash while whatever few remaining monetarists who didn’t fuse into neo-Keynesianism think Fed whenever they are reluctantly forced to think about money at all.

The one thing the Federal Reserve or any these so-called central banks never discuss, talk about, or will even mention is…money. They literally don’t even know where to begin. To get around this glaring omission they’ve been calling interest rate targeting a monetary policy when the two could not be more different.

However, when speaking the truth you find yourself relegated to the fringes. MMT, for example, gets the basic mechanics but then goes off into Socialist Utopia as if virtual ledger money can be the gateway to the Marxian dream of abolishing money altogether.

The opposite fringe, which is slowly becoming mainstream, is reserveless cryptocurrencies and some others like digital stablecoins (for more information and discussion on those, there are three conversations I had a few months ago available in the Conversation section of the DDA website at the menu above).

Funny thing is, crypto begins from the wrong premise, the Fed printing money, but is moving in the right direction using the right tools (IMHO). MMT starts strong before quickly turning into batsh-- crazytown.

The forces of good just can’t seem to align, thanks mostly to the primitive ideology that dominates by enforcing rules of heresy.

This massive monetary illiteracy explains so much more than you think. What I mean is, the real money that we use today and have since before the time of Minsky has been demoted for decades to the fringes of accepted discourse. The most ignorant of all people, the neo-Keynesians, are those who are put in charge of what they say is our monetary system and, even worse, the public continues to look to these overeducated bureaucrats for all the answers.

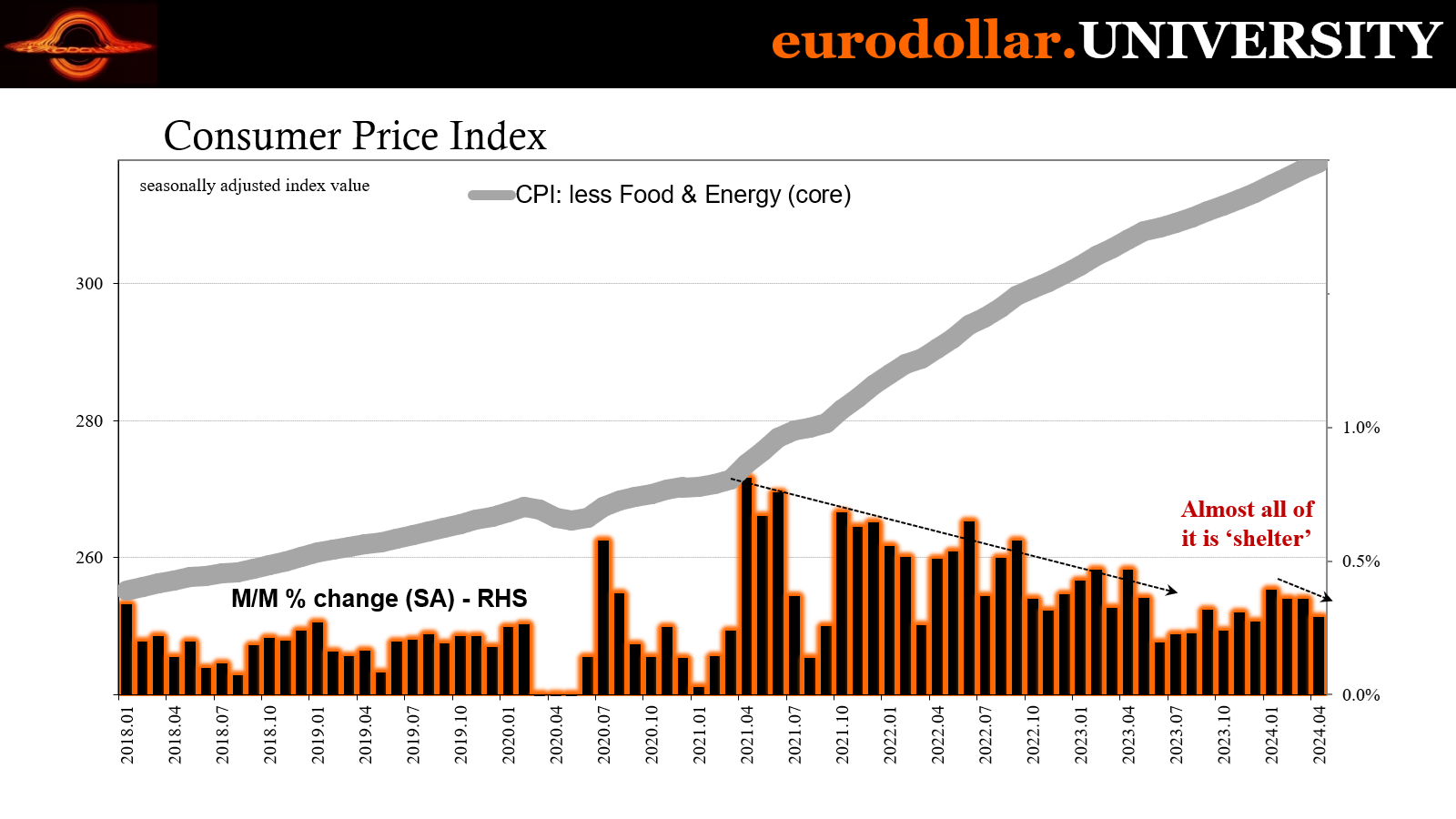

Bernstein clearly didn’t know what he was trying to say, but even in his befuddled muddle of an attempted answer he was closer to the truth than Jay Powell has ever been or will be. That guy is still scouring the CPI to make broad inferences about money, rather than monitoring real money as is his real job.

On that note, today’s CPI was unsurprisingly disinflationary (retail sales incredibly weak), more reflective of the correlations I brought out in yesterday’s DDA examination than what Economists purport of Phillips and expectations theory. The April consumer price estimates returned to (in truth, they never actually left) the same general disinflation as producer prices while remaining completely unrelated to expectations or the Phillips Curve (except the current accident of circumstances where unemployment is likely rising these days while consumer price pressures are diminishing).

The fact there is no base money explains the entire modern world we live in, the bad as well as what had been a lot of very good.