GASOIL AND MORE RECORD SWAPS

EDU DDA Nov. 5, 2024

Summary: While everyone has been watching US labor data and now fixated on the election, there have been some major developments. Energy markets are bracing for a supply surplus in the world’s most critical fuel. And swap spreads absolutely plunged throughout last week’s critical macro gauntlet and up through yesterday. All three major maturities including the 5-year for the first time set more record negatives.

Still inside the shadow of the last payroll report in the US, with the presidential election taking up all the spotlight, the International Energy Agency (IEA) announcement that it now expects gasoil demand to outright decline in 2024 has gone almost entirely unnoticed. That’s an astounding development and one which mirrors the same summer stumble in US jobs not to mention a bunch of other indications for the global economy.

Very much related, over the past week up to yesterday, swap spreads had absolutely plunged (see: charts). All the major maturities - starting with the 10-year and 30-year, now for the first time including the 5-year - set new SOFR-based lows while converging on the record lows (assuming a valid conversion) from their LIBOR predecessors in 2020 and 2016. These are not positive comparisons.

I’ve been focused on collateral indications which are a significant factor in the swaps market, so that’s very likely a candidate as is the macro backdrop depicted in both gasoil and seriously flagging US employment; this isn’t an either/or situation since deterioration in swaps very likely has to do with both. In point of fact, given the yen/Japan connection, there’s a good chance the collateral difficulties are themselves tied to rising “macro uncertainty” getting more certain with most new developments.

Taking the first one first, gasoil, the IEA said that it now expects demand for this essential fuel – gasoil is an umbrella term for various types of diesel - in 2024 to be a very small amount less than in 2023. Don’t let the underwhelming description lull you, as I covered this on YT today but here’s Bloomberg’s summary of the mildly shocking findings:

The world’s demand for diesel is forecast to fall this year, a rare event for the fuel that powers swathes of the global economy.

The Paris-based International Energy Agency has for months been chipping away at its forecast for the year, and now expects annual consumption of gasoil — a catch-all term for diesel-type fuels — to fall by 258,000 barrels a day. Outside the pandemic, it’s set to be the biggest drop since 2016, with demand only falling a handful of times in the last 15 years.

While, as always, the media will point the finger at China, not without good reason, we’ve been tracking US weakness all throughout the summertime and from within the energy complex itself. That corresponds with IEA’s shifting and downgrading demand estimates.

During the late summer, various reports surfaced showing major US refiners were taking additional maintenance way more than is usual for the time of year, more production capacity offline than any other time since 2020. Sure enough, the IEA says the decline in gasoil demand is also the first since then, too.

Since energy demand is price inelastic, and prices have remained relatively soft all year anyway, lower demand for it is entirely a macro property. We use as much energy as the economy requires almost regardless for price (with only the most extreme cases such as March 2022 significantly altering usage), meaning if we find falling demand it can only be because of a faltering economy.

This is by no means an infallible signal, though given its connection to the real world (actual production leading to physical inventories of real commodities) this certainly doesn’t have the same level of ambiguity or revision problem of, say, the Establishment Survey. Since gasoil/diesel touches practically every aspect of the real economy, it’ comprehensive, too.

IEA as well as the World Bank are expecting a substantial surplus of crude oil and diesel heading into next year, a far cry from the beginning of the supply shock, though a predictably fitting bookend to it.

For the swap market, there’s been a flurry of trading since last Monday sending spreads even lower than they’ve been – and not by a little. The late July/early August drop in spreads seems like ancient history from a substantially higher (less negative) perch as if those earlier results came from a wholly more benign environment (obviously not the case).

What’s driving them lower? A combination of issues.

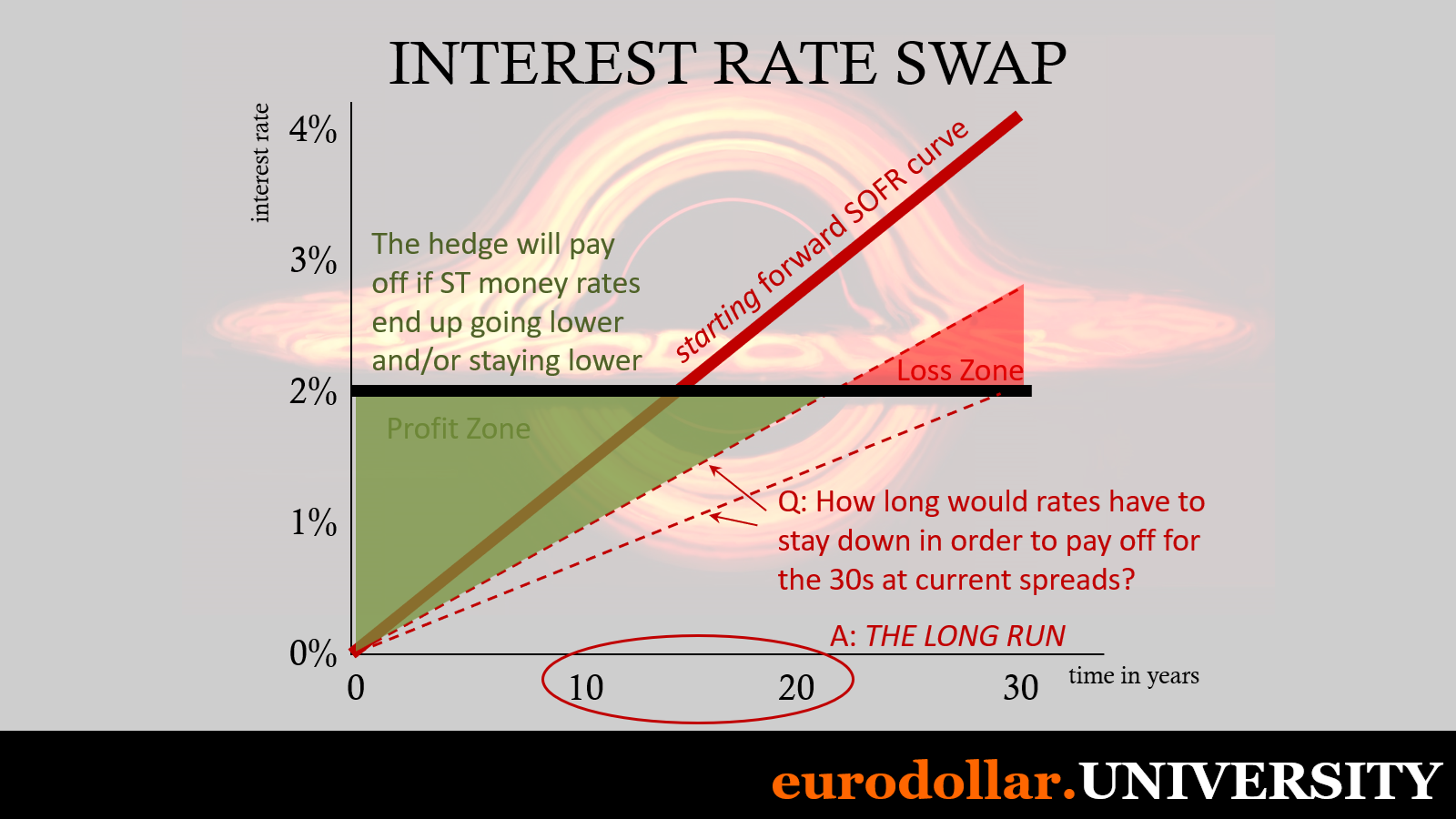

First, macro. US recession is far more profound than simply US recession. Remember what swap spreads are all about. Longer-dated contracts are influenced by long run factors. More negative spreads signify not just rising expectations for lower rates, more importantly that they’ll have to stay low for a prolonged period to justify those increasingly record negative spreads.

For more background on swaps and spreads, below are the latest two of Eurodollar University’s Basics Videos covering the basics of swaps and beginning to examine spreads (the second video, #12, looks at swaps from the all-important dealer perspective which will be relevant to what we’re going over here; I’m in the process of putting together #13 which will look into swaps from the point of view of hedging demand).

A soft landing would have meant the country and the world had managed to skate by the last four years suffering no permanent loss of potential. To make it into one would have also required some substantial catch-up in purchasing power for consumers and businesses, otherwise avoiding contraction and retrenchment would be impossible.

In that optimistic, positive scenario, fundamentally interest rates would need to rise (higher growth and inflation expectations) and would also necessarily mean fewer rate cuts (if any) from the Fed at the short end. So, not what swaps have been pricing.

Swap spreads would be unwinding and decompressing (becoming less negative) rather than what they’ve been doing since last summer.

Instead, the long run view from swap spreads is a constantly rising now near-deafening probability of even lower interest rates that stay that way for an even-longer period of time (that’s the more negative). A recession wouldn’t necessarily be required to achieve that sort of future potential, though one does make sense as the method of transitioning from the artificial macro highs of the supply shock period.

This is the nominal vs. real divide, one that would have had to close a lot more than it ever did in order for the soft landing to work. Swaps just aren’t seeing it and as more macro data aligns against the possibility the more negative spreads go.

From the financial perspective, there is the demand for hedging against these scenarios, a higher degree of safety in those lower for longer long run rates. This is even more impressive now than it already appears, too, given the current shape of the forward rate curve (which is what swap prices are derived from; unfortunately, this will be covered under Basics #13 so it isn’t available yet). Swap spreads are, basically, measured deviations from that forward curve, in this case SOFR.

As the forward curve itself bends down as we get closer to, and start to get, central bank rate cuts (Fed policies drive SOFR rates), there has to be an even bigger expectation for even lower ST rates for swap prices to perform as they have.

The other possibility – and these are by no means mutually exclusive – is that the other side is the reason for negative spreads, meaning dealer perceptions and actions. Since dealers are in on one side of every swap transaction (this is covered in both Basics vids), their balance sheet factors are in the price of every single interest rate swap and spread.

Part of those balance sheet considerations is pure volatility and uncertainty, meaning perceptions of information from within the marketplace. Put yourself in the shoes of a swap dealer who is suddenly inundated with demand for taking fixed from clients all over the marketplace. Not only that, these same clients are willing to accept lower and lower fixed rate payments.

You’d naturally wonder what they’re seeing that maybe you aren’t (assuming you haven’t already been informed from somewhere else in the activities of the organization). Absent some benign or technical explanation (regulator change or calendar-related phenomenon), you’d prudently react by becoming a lot more cautious and not just within the swap desk or that marketplace.

Dealers have all this information which informs their balance sheet factors and deployment, so they may see what I describe above, make few changes in their swap quotes and placements only to then lighten up in other ways through other activities – such as collateral flow.

Money dealers also respond more directly to perceptions of collateral in swaps markets. Shorter version: like wholesale money, the only way to have truly scaled swaps was through collateral otherwise dealers would be stuck scrutinizing every counterparty for payment risks. That also means there’s collateral posted in almost every transaction.

If dealers perceive the collateral being posted as increasingly less-than-desirable, in lieu of requiring more from the fixed-rate receiver the bank could instead accept a higher return, in this case being able to pay a lower fixed rate relative to Treasury yields, creating a more negative swap spread. For anyone seeking a rate swap hedge without collateral, same idea – give the dealer more compensation by taking a lower fixed rate payment from it.

For several possible reasons, dealers can and do move the fixed rate therefore impacting the swap spread, tied closely to perceptions of risks across several dimensions. We can’t know exactly what those are or might be since we don’t have any access nor is any money dealer going to volunteer highly-guarded inside knowledge. Even sticking to broad interpretations, what we do know is from the dealers’ side lower and more negative swap spreads fit with rising risk perceptions and risk mitigation actions up to and including collateral.

We’ve been seeing – and I’ve been cataloging - more of those since early August given the clear shift in repo fails and the corresponding drop in 3-month J-bills, both related to yen carry trade changes and the effects from them. Another summary: fears of higher US recession risks cause more unwinding, disrupting markets for esoteric credits causing liquidity ripples that then become collateral reconsiderations.

Scarcity in this manner becomes a function of the same macro risk.

As far as Japanese bills, they continue to yield near zero, way less than the BoJ’s O/N rate of 25 bps. Moreover, though not a huge and obvious shift, their yield has dropped back closer to zero within the same timeframe as this latest sharp drop in swap spreads; the latter dumping starting on October 28 while the former, J-bills, moved back down from the 29th after only a small backup in those yields before then.

Not only that, I highlighted the sharp drop in the 4-week US Treasury bill rate last Thursday even before the payroll report was released on Friday. Though the 4w bill yield is also behaving as it would with the market expecting the next rate cut (Thursday) from the Fed, like in early September there’s a little extra buying evident for the instrument.

After today, it has already equaled the 8-week even though there are two rate cuts in the latter’s maturity window as opposed to the one for the 4w. Furthermore, the “investment yield” calculated by the Treasury is closing in on one-month SOFR like it had two months ago even though term SOFR is itself heading downward anticipating the same rate cuts.

There have been an awful lot of stronger signals continuing to align – though recognizing the data isn’t uniform. A perfect counter-example also from today, the ISM’s non-manufacturing index which soared to a nearly two-year high largely due to a five-point pickup in, get this, its employment index previously languishing solidly in recession territory just a few months ago. Then again, that may be why there was little reaction to the release, though it also just might be overshadowed by today’s Main Event.

Remember, swaps and spreads only tell us probabilities about the future trajectory and behavior of interest rates. The rest of it is interpretation, in this case – since this is EDU’s DDA, my interpretation. What swaps are saying is nothing more than how there must be a variety of factors all coming together in the same way such that interest rates – specifically SOFR – ends up a lot lower than where it is right now (already moving lower) then stays there.

Recent labor stats suggesting the possibility of serious weakening over the summer combined with what the IEA said about diesel, already aligned with energy signals from the past few months, there is a whole lot of evidence for the macro interpretation as I sketched out. Maybe that doesn’t involve recession, though I believe the chances are getting stronger with each drop in bill yields and swap spreads.

Then there are the collateral signals where, despite what should an overabundance of T-bills, demand is unusually high for 3-month J-bills on top of the 4-week UST issue. Given the yen end of things, that also trends solidly toward US macro risk, as well.

Not only do swap spreads give us a signal in that regard, the level of those spreads (negativity) also indicates intensity therefore a rough measure of probability. They went totally crazy last week which coincidentally or not happened to be a very busy one. Other than GDP, nominal incomes tagged labor plus JOLTS looked ugly then finally payrolls and the Household Survey.