EVERYONE LOVED THE FAKE RATE CUTS, TOO

EDU DDA Aug. 22, 2024

Summary: We're finally on the cusp of rate cuts, therefore rate cut mania. This unqualified acceptance of interest rate policies is downright irrational. Not only is there overwhelming evidence against it, we even have a case where the rate cuts themselves were inarguable FAKE. Yet, sadly, predictably, they were widely hailed as if the naked emperor has been finely appointed by the most skilled tradesmen. He is; only their trade isn't tailoring.

ARE CENTRAL BANKERS THE EMPEROR, OR THE TAILOR? NEITHER!

While the entire world now turns to more than talk of central bank rate cuts, what’s missing from the conversation as a start is any actual substance. In this case the silence is more than deafening, it’s enough to make you believe we really are living in a simulation; or that the asylum truly is being run by the inmates.

The tale of the emperor who had no clothes is even inadequate, though at least in the right spirit and general sense of the matter. People will refer to rate cuts as “stimulus” without ever once citing what might actually get stimulated or how. Cheap borrowing, or something.

What about rate cuts that don’t even cheapen borrowing? I’ll get to those in a minute.

People will say the Fed or ECB’s rate cuts will help cushion the economy either unaware that they never have (2019 is a different and inconclusive case while 1996 was never a danger of recession in the first place) or unwilling to tell the truth. Neither are positive commentaries on the state of the financial media which, of course, values access over fact.

Jay Powell tomorrow at Jackson Hole will be exploring this very topic, yet not once will he be challenged to back up any of his claims. The truth of the matter is nothing more complicated than rate cutting as pure symbolism so everyone must play a part. Its entire purpose is, well, actually the spectacle on display in Wyoming.

Being a part of the theater is well-paying.

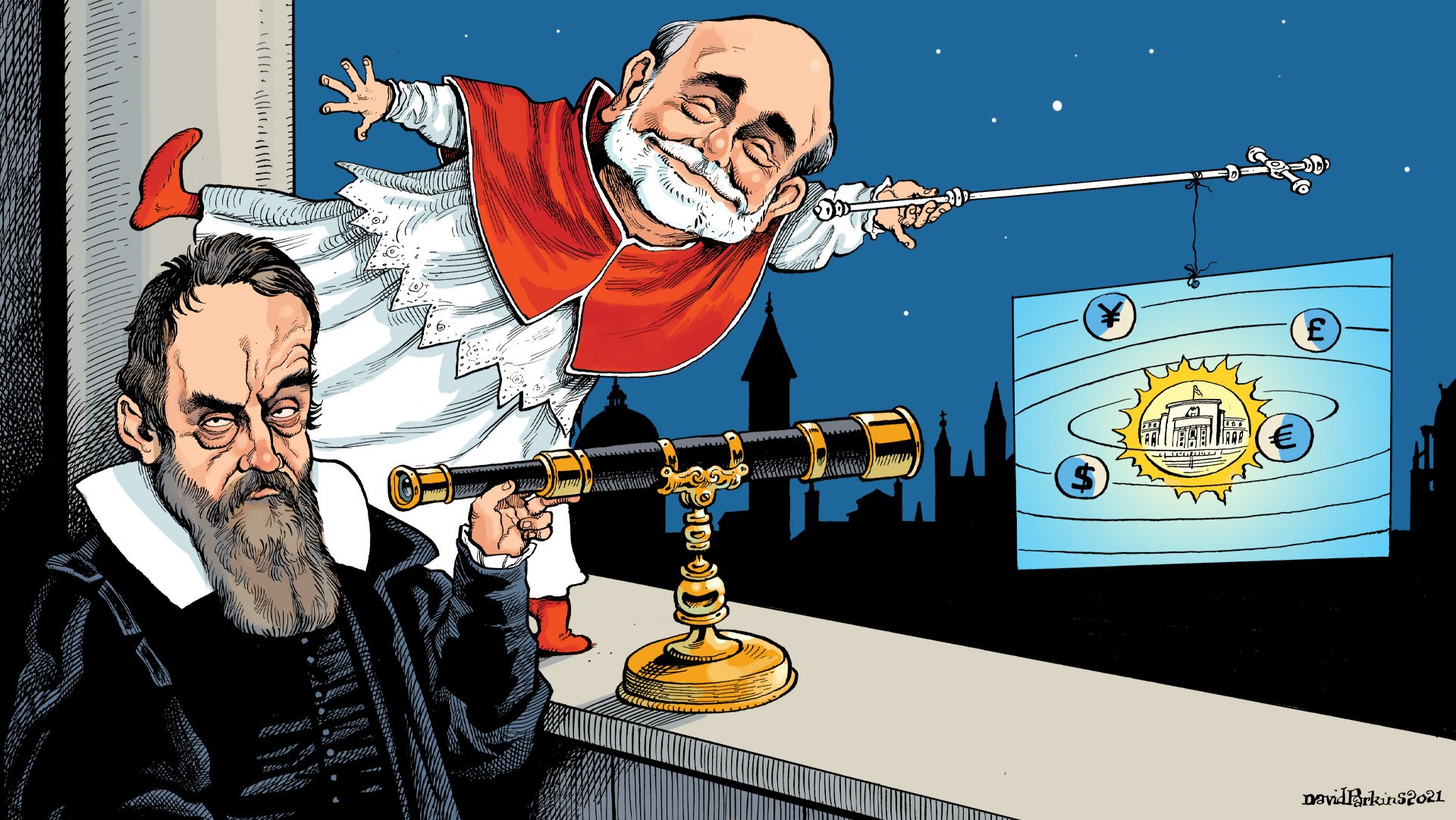

The act of announcing something is the entire point. Economists are little more than statisticians practicing astrology while playing psychologist. They believe that by first establishing themselves as all-powerful this gives officials the leeway to do nothing and call it something. Just stand apart and look at the whole affair, it is purposefully ritualistic even religious so as to inspire belief not convince through fact (or truth).

Unlike central bankers, I’m willing to back up my claim with history and evidence. I’ve already done much of that work easily citing the performance of interest rate targeting during past cycles. The record is damning, a perfect 100% failure rate which includes the late Great Inflation recessions along with those which followed afterward right up to the Great not-Recession disaster (which won Ben Bernanke, of all people, a Nobel Prize equivalent if only to keep up these appearances).

The European recession in 2011-12 as the lone example post-2008 is in the same category and where we will focus here because it laid the groundwork for the fake rate cuts I’m examining here.

During this time, the ECB had inadvertently provided the most perfect example of exactly what I’m talking about. In the other cases, you can at least make some theoretical argument about how lowering ST benchmarks does something in the financial system. It isn’t true, but it at least sounds plausible. For the rate cuts Mario Draghi delivered in 2013, you can’t even do that much…not that anyone seems to have noticed.

To begin with, the ECB had first hiked rates in early 2011 fearing inflation was breaking out only to reverse course just months later as instead Europe fell into a damaging recession with another banking crisis to boot. While it was underway, the central bank cut its rate “corridor” by 25 bps each November 9, 2011, December 14, 2011, and then July 11, 2012.

The rate corridor refers to the Europeans’ three main policy benchmarks: the actual target called the Main Refinancing Operation (or MRO) which is like the Federal Reserve’s old fed funds target; the Deposit facility rate which acts as a floor (similar to what IOR and RRP were supposed to do for US$ markets); and the MLR, or Marginal Lending Facility, which is above both and exists as an emergency liquidity tap (similar to the Discount Window/Primary Credit). The purpose of the corridor is to have different means to influence ST money rates to ensure they stay in a range where policymakers want them.

If rates go too low, the Deposit Facility as an alternative to money markets means no market participant should ever accept a lower return since they can just park funds (euro reserves) with the ECB. The MLF helps ensure money rates don’t go too high since banks in good order can borrow from it and then relend into the marketplace to anyone paying higher rates (this one is more questionable).

The MRO is also called the midpoint since it sits in the middle though its function had been devalued by other operations during this same 2011-12 timeframe. Basically, responding to this second banking crisis as European government bonds as collateral were being repriced causing repo markets to fail and banks to threaten the edge of insolvency, authorities had opened several liquidity auctions (LTROs) which meant a lot of excess reserves floating around the euro system.

While they didn’t do much to fix the problem nor keep Europe out of recession, they did suppress ST euro-denominated money rates from repo to Eonia (we’ll focus here on the latter). There were a lot of reserves banks didn’t have much use for (remember, central banks control the supply of reserves and add or subtract them regardless of demand), pushing money rates well under the MRO by the middle of 2012 all the way to nearly the Deposit floor.

When the ECB lowered rates for the third time that July, just before Mario Draghi’s infamous “promise” to save Europe at any cost, the Deposit rate dropped to zero percent. The MRO was still at 50 bps with the MLF at 100 bps. The reason why they were so low after only three cuts was that policy benchmarks were already down near the zero-lower bound after the first crisis just a few years before – again, raising the question, what good was any of that?

Europe’s economy began to recover by early 2013 though it was unusually sluggish (compared to expectations of “ultra-accommodative” interest rates). Worse, consumer prices began to sag. In reality, the contraction in Europe may have concluded but the malaise, the Silent Depression was still ongoing (and already ravaging more parts of the world). Toward the end of the year, consumer price increases had shockingly fallen under 1% (again, what good were the low rates?!)

Just after the shocking consumer price change was announced, in November 2013 Draghi wasted no time in cutting rates again. But, there was now a snag: the Deposit facility was already at zero. Not wanting to go full negative interest rates (NIRP) just yet, the ECB instead cut the MRO and MLF while leaving the Deposit rate where it was.

The media hailed the quick-acting surprise action while at the same time the usual critics, mainly with German surnames, blasted authorities for opening the door to permanent inflation or worse from such reckless “easy money” policy. Both camps, oddly, agreed at the very least such a major step was likely to lead to a lower euro exchange value, the latter group arguing it was a dirty devaluation tactic whereas the former called it more genius indirect stimulus.

Here's what The New York Times wrote of both on November 8, 2013:

Predictably, the rate cut won praise from countries with weak economies — and drew criticism from Germany, which has a historical aversion to inflation and fears that looser money will lead to profligacy among the euro zone’s more financially troubled members.

Pierre Moscovici, the French finance minister, said in a Twitter message that the rate cut provided “welcome support for the ongoing recovery in the euro zone by limiting the risk of deflation.”

But a German banking group expressed dismay. “Unprecedented low interest rates substantially devalue savings in Germany and the euro area and increase the danger of bubbles,” the Association of German Public Banks said in a statement.

OK, how? Seriously. Either side of the argument. HOW?!

What’s worse is that the November 2013 cut was the second completely fake one in a matter of a few months, Draghi having done one earlier in May. Again, what did the first achieve if consumer prices threatened deflation anyway? So, why bother with a second?

It’s all just theater because that’s all these people have.

When I write that the rate cut was “fake” I mean that in a technical way as much as in reality. All central bank rate cuts are fake in the sense they don’t actually stimulate. These two, however, were different in that they didn’t even move money market rates! At least with any others, ST market rates would at least change with the benchmarks, not here.

If you didn’t catch the trick don’t worry, no one else seems to have, either. It begins with the LTROs in late 2011 and 2012. The impact, as I wrote, on money rates was to depress them below the MRO; too many reserves and really no demand for them. Eonia, the main unsecured euro rate (like fed funds), dropped to just barely above the Deposit facility rate floor.

Remember, that floor was set to zero by the final of the three recession period cuts in July 2012. Since the ECB wasn’t willing to go full negative in 2013 (which requires another somewhat separate examination about why that was and what was supposed to have happened but didn’t when they eventually did go NIRP), therefore when the ECB “cut rates” in May and November 2013 both times it was only the two, the MRO and MLF.

Those two policy benchmarks changed but money rates stayed just the same. Eonia didn’t even notice there had been these two policy cuts, they were both pure symbolism.

Nothing changed except the ECB got to make an announcement talking about exceptionally low interest rates that…applied to no one and nothing in any real sense. Literally fake rate cuts. There was no need of refinancing operations with the LTROs and like the Fed’s Discount Window no one ever used the MLF. Lowering those was entirely for appearances.

Now reread the quote above; what were those people NYT cited even talking about? Limiting deflation? Substantially devaluing the savings of Germany? WTAF?

Both sides, too, proponents and critics alike. They all just assume (or lie) that lowering any rate, and obviously it doesn’t matter which one or what it does, that it must stimulate something somewhere somehow.

Yet, in the case of 2013, the ECB changed only two numbers and that’s it. Everyone went nuts over nothing. None of it worked, obviously; or it should be obvious. The ECB was busy starting in 2014 with more and even “greater” theater (T-LTROs, negative rates and eventually full-on QE).

Here’s the thing; that nothing wasn’t really much different from any other rate cut. While you can say with the others that money rates did move around, as we see from historical results time and time again that doesn’t matter or, at most, doesn’t matter nearly enough to make a detectable difference in either finance or most importantly economy.

Central bankers are the puppet masters only in the respect they control a narrative, and that, you have to hand it to them, they’ve done exceptionally well. Even their critics are critics only in the respect they don’t like them having all this “power.” How is this not the Matrix? It is thoroughly maddening and astonishing all at once.

We really do still live in the Dark Ages, ruled by superstition under as anti-scientific political doctrine as any feudal despot claiming divine right through the placement of the moon in a random window or the shape of some birthmark. Where’s the media? Clamoring and competing only to be as close as possible to the aura of the invisible.

Of course, as if that wasn’t bad enough on its own, there are very real consequences. Start with the 2010s and what led up to 2013. Europe had experienced two quick and utterly devastating recessions despite “ultra-accommodation” on all fronts. What did any of it accomplish? They’ll all tell you, well, it would’ve been worse without it, “jobs saved”, the unfalsifiable counterfactual and telltale sign of the habitual liar.

With recession increasingly staring down the world in every way, central banks are flipping from rate hikes (which didn’t seem to have much impact on consumer prices) to now rate cuts and the celebration over them has only been turned up to eleven. The Fed, the Swedes, the ECB, there’ll be cutting all around the world and soon to be a lot of it.

Maybe Ben Bernanke does deserve that Nobel, after all. Not for actual economics, obviously, instead for what Economics really is. He is the King of Fake. Draghi did a masterful job to imitate and Powell will be coming after the crown, too. All of it based on what, exactly?