If you aren’t a Eurodollar University member, become one and get access to Classroom vids, The Basics, Weekly Recaps, Q&As, and all the special presentations right here.

Wicksell’s Depression Star, Part 3

The conclusion to the series. Depression Economics. Protracted Non-neutrality. Sure enough, Economists’ calculations for R-star are entire consistent with Ben Bernanke’s earlier scholarly work, Friedman’s interest rate fallacy, and, most of all, Wicksell’s Depression Star. The eurodollar factor is what links them all.

Wicksell’s Depression Star, Part 2

The S&L Crisis of the eighties had left thousands of fail banks in its wake. Yet, there was no Great Depression 2 following it. On the contrary, the period was marked by unparalleled global prosperity. To really understand and appreciate the difference, we turn to the basic fundamental economics of interest rates. And Ben Bernanke.

Wicksell’s Depression Star, Part 1

Hundreds of banks failing. Big ones, too. Deposit flight. Wall Street rescues. Fed emergency loans. The first bank holiday since the great depression. It’s not March 2023.

Jeff on Hidden Forces/Demetri Kofinas

Jeff sits down with Demetri Kofinas at Hidden Forces for another long interview. The second half of the previous interview from January is being made available to Eurodollar University members, and Demetri is offering a huge discount off the price of joining his Genius Community. Details inside.

MacroVoices #362 Jeff Snider: Soft Landing or Crash Landing?

Jeff’s most recent interview with our good friend and original Eurodollar University instigator Erik Townsend of MacroVoices.

What 'We' Are Missing, Complexity Part 5

In the final chapter, completing what is and will be Eurodollar University’s mission statement, we examine why we all need to care about all that stuff from fifteen years. History has repeatedly shown that it is Little Guy who pays heavy price for these massive monetary mistakes. We’ve been lied to long enough.

What 'We' Are Missing, Complexity Part 4

It was never subprime mortgages and because it wasn’t the Federal Reserve was completely unprepared. The Great Collapse of the 21st century was, in many ways, similar to the earlier one. But where that had meant the evolution of deposit money in the 1920s, the second half of the 20th was all about global money.

What 'We' Are Missing, Complexity Part 3

Whether the Great Depression or the Great ‘Recession’, Federal Reserve policymakers claim their policies are effective in spite of the overwhelmingly disastrous results which conclusively prove otherwise. When the momentum of truth arrived, officials in both time periods utterly failed for the same reason - they didn’t know what they were doing.

What 'We' Are Missing, Complexity Part 2

In the textbook, money and monetary policies are easy, like flipping a switch. For the longest time, it had become taken for granted that central banks could employ a very simple lever to exercise control over seemingly everything. Is that how it really worked? What might happen if it wasn’t, then didn’t? History would repeat.

What 'We' Are Missing, Complexity Part 1

History doesn’t just repeat, it has repeated. Before we explore the repeating, we’ll first examine the previous occurrence to see what we can learn from it authorities did not. From massive monetary innovation to policymakers not keeping up with it and therefore officials wholly unprepared when the time came; October 1929 like August 2007.

Wholesale Revolution, Part 3

The Federal Reserve was designed specifically to handle the monetary crisis in ‘07 - 1907. If the monetary system had simply remained as it was back then, there wouldn’t have been 1929 nor 2007 (and so much in between). But the system did keep evolving even if authorities refused to keep up and we all paid the price.

Wholesale Revolution, Part 2

We don’t get to the eurodollar system’s long chains of interbank transactions without having first developed an intricate, useful interbank system. Maybe surprising to some, the Federal Reserve was supposed to be its replacement…until it wasn’t.

Wholesale Revolution, Part 1

Before there were long chains of interbank transactions in the eurodollar interbank ledger, there had to be an interbank ledger. The history of bank networks is fundamental to what money has since become.

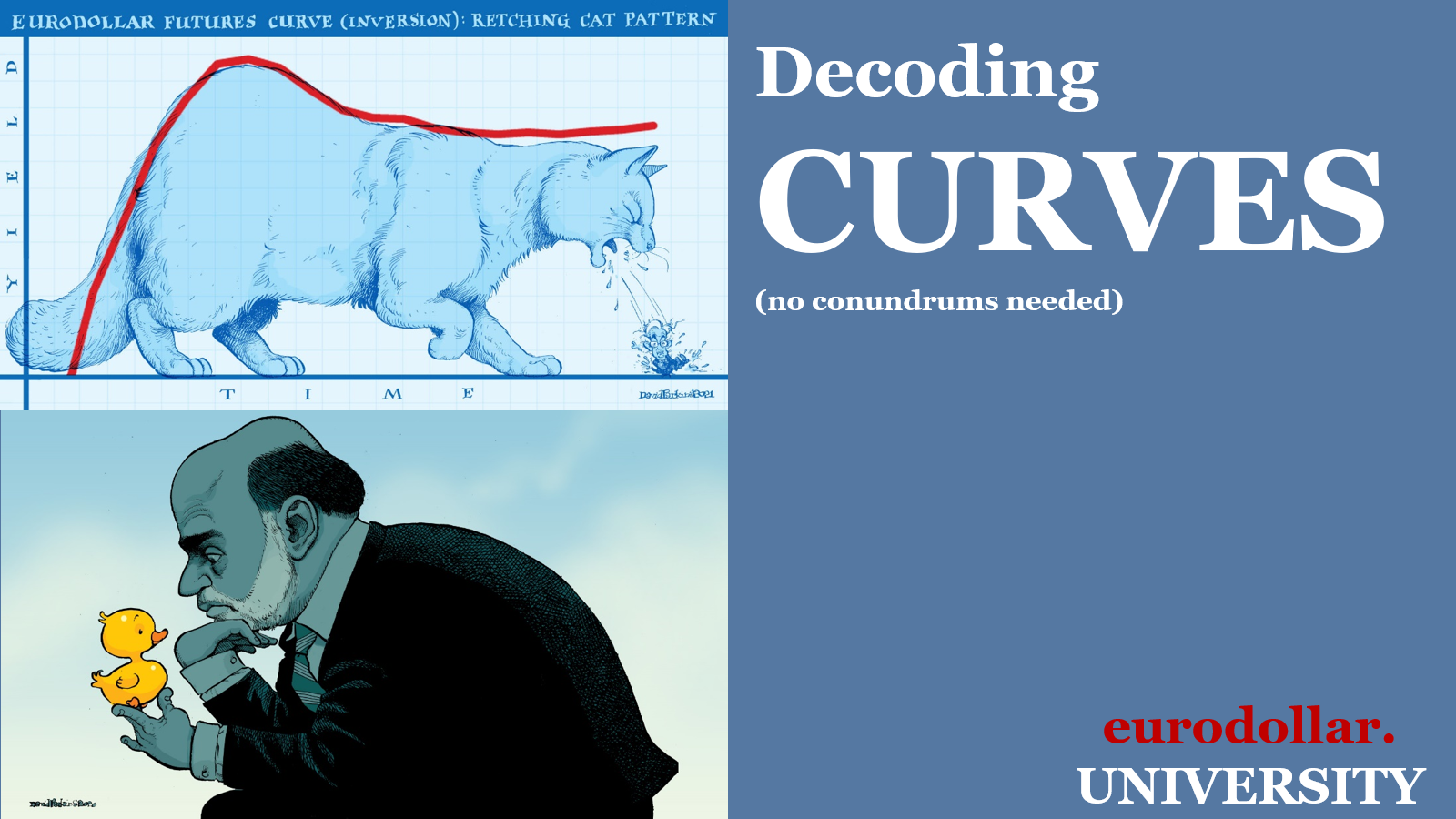

Decoding Curves, No Conundrums Needed; Part 3

Find out what Fast Eddie’s handiwork led the world toward. And while we all moved toward our shared monetary fate, those who said they wouldn’t let it happen could only tell something big was happening without figuring out what it was. They should’ve decoded the curves.

Decoding Curves, No Conundrums Needed; Part 2

Who better to represent the wild and radical transformation of money and banking than a former bond analyst turned banker sporting the name of a barroom pool hustler. Having turned the monetary world upside down, no wonder the official world could no longer make sense of money and financial signals.

Decoding Curves, No Conundrums Needed; Part 1

One of my favorite presentations, we go back to January 2019. Rate hikes but everything going wrong. Inflation, where’d it go? Curves inverted, confusing policymakers and the public. It sounds really familiar, doesn’t it.

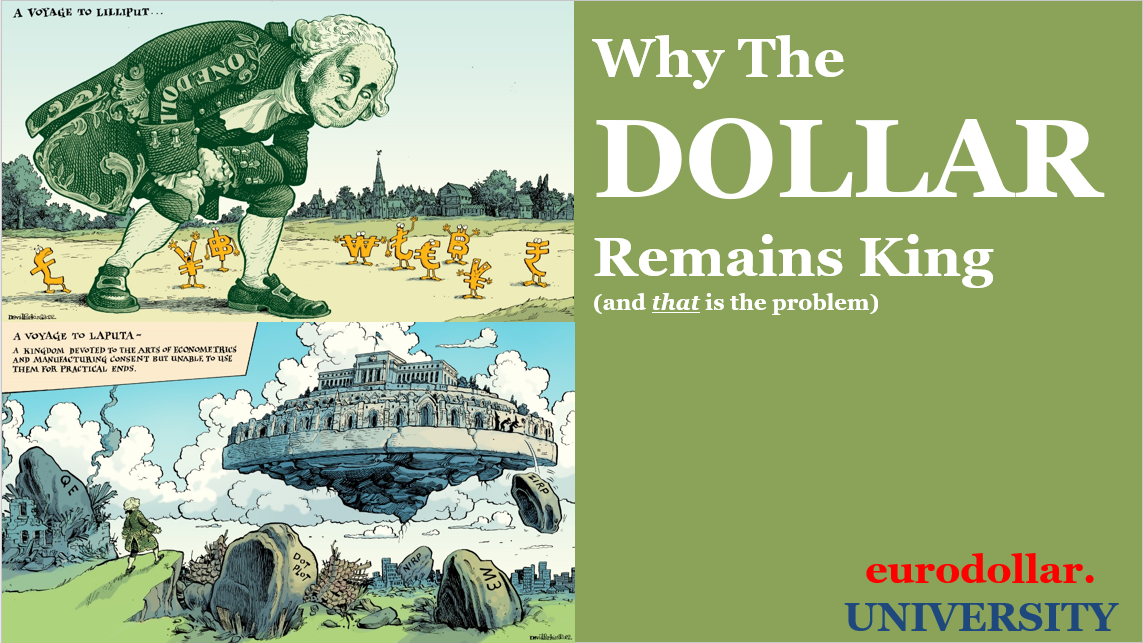

Money Mysticism (why the dollar remains king) Part 3

The conclusion of the whole series, Ghost Money and Money Mysticism. From the days of Volcker, we’ve been misled. That doesn’t mean it’s impossible to figure everything out. In fact, in their own words, it’s all right there.

Money Mysticism (why the dollar remains king) Part 2

The highly anticipated (maybe?) sequel to Ghost Money. If interest rates and the Fed don’t explain the dollar, then what does? And why does it matter?

Money Mysticism (why the dollar remains king) Part 1

The highly anticipated (maybe?) sequel to Ghost Money. Explaining the crypto crash starting with common money misperceptions - and memes.