Daily Briefing 1/15/25

Consumer Prices (BLS)

The CPI for December 2024 came in at a 0.39% month-over-month increase, fastest since February. Year-over-year, the index gained 2.90%, highest since last July. The core measure, by contrast, slowed to 0.23% m/m (vs. 0.31% m/m in November) and dipped to 3.25% y/y (vs. 3.30%). The divergence was fed by motor fuel inexplicably soaring by more than 4% m/m. At the same time shelter prices decelerated to 0.26% m/m, a three-month low, even as OER was slightly higher at 0.31% m/m last month compared to 0.23% m/m prior (a cycle low). Excluding rent, services prices rebounded to a 0.36% m/m pace from 0.13% m/m in November.

Interpretation

The reaction to the CPI was swift and decisive, for once. It was a notable development since, overall, the data itself would be best be characterized as “mixed.” The core rate was better than expectations and slowed with shelter prices predictably (and belatedly) coming down. On the other side, gasoline soared for reasons, I guess, and put the headline index higher than last month and expectations.

Maybe observers realized the gas estimate was a real one-off and therefore were looking past it to the rest of the data. The remaining balance of the report was really the same as everything before now. By this point, everyone should be well-aware of the lumpiness, how disinflation comes and goes in multi-month chunks.

What’s most confounding is that those individual parts can never seem to really sync up except in too few (for most of the public and impatient Economists egged-on by inflation-ists who hold an incorrect view of inflation) periods such as last summer. That doesn’t mean the trend changed, it’s consistently there even as this back-and-forth process keeps coming.

Maybe the best way to look at this is when stripping out the fake imputation of rent (beginning from Owners’ Equivalent Rent, or OER). Everything else in the CPI bucket accelerated in December, rising together at a 0.47% m/m rate, which was actually the fastest going back to August 2023. Yet, that only brought the annual rate to 1.94%, which equals about a quarter to a third less for the PCE Deflator.

In other words, even on an upswing the annual rate is quite tame with significant margin to spare.

Perhaps this latest month was finally enough confirmation. For those who might have been worried prices were about to accelerate uncontrollably, the December estimates showed it just isn’t likely, while also exposing some of the “stickiness” as more imaginary than even statistical let alone real economy.

CPI Trigger

The Treasury market experienced a sharp reversal today after the December CPI report. As noted above, the consumer price numbers were fairly unremarkable when viewed in isolation, basically more of the same. It may be that more of the same is a shock to participants and “conventional wisdom” given how chaotic commentary and rhetoric on the “inflation” question had gotten to be.

To hear so many people talk, this was 1973 all over again (they even produced charts for this not realizing it disproved the entire idea). The fact no one from the Federal Reserve would come out with anything close to a confident opinion only added fuel to the fever. If anything, the FOMC - starting with Chair Powell - stoked as much fear as the usual mainstream suspects.

Rather than provide any guidance or direction, the best the public got from officials is, we have no clue. They all said they’d be content to sit and wait simply because they don’t have any idea what to believe. The fact policymakers admitted this is itself stunning. Categorizing it as “data dependent” wasn’t really an effective cover in these circumstances.

Then again, after being stung by 2022, no one at the Fed is ever going to willingly stick their neck out again – despite the fact transitory was indeed correct.

What the CPI data seems to have done is take some of that upside “inflation” case out of even Fed thinking. The December estimates confirmed the disinflationary process and more, how it is not a straight line and that we should expect multi-month periods of accelerating prices, or certain classes of prices; that it isn’t anything to get excited about or blow so far out of proportion regardless of what anyone at the FOMC thinks or is willing to say out loud.

The 10-year Treasury which was flirting with 4.80% the past two days was bid all the way down to 4.64% at one point, before finishing at 4.66%. That’s a 12-bps drop from yesterday’s close, an even larger one-day decline than in mid-July when the June CPI report came out; and that one was filled with all kinds of remarkable developments.

Even the 2s, which had previously been left out of the selloff, that maturity gained substantial attention, shedding 10-bps in yield. For one day, anyway, it acknowledges the CPI’s confirmation about limited (non-existent) upside consumer price risks, as likely interpreted by those at the Fed.

The buying today was sufficient to have round-tripped last Friday’s payroll selloff. Of course, beyond the short run all bets are off since you can’t predict dynamic markets. From a fundamental perspective, it does count as significant macro confirmation.

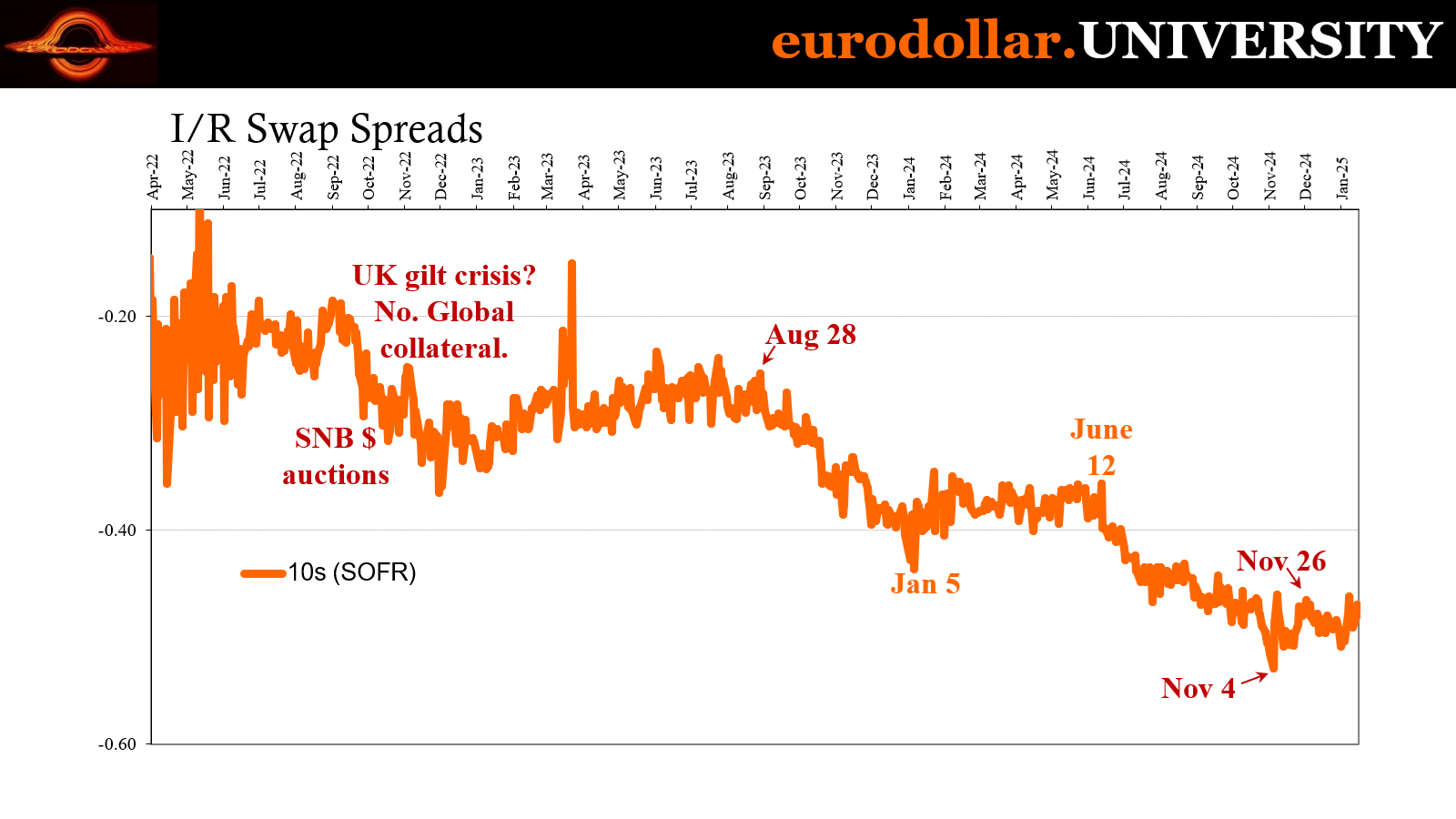

You can see that in the swap market, meaning how shorter-term spreads have gone sideways or higher (5s) during this “inflation” fear flare-up whereas the longer-dated 30s remain true to its trend. The shorter-term contract spreads pricing the lack of Fed clarity while the longer-term can look past it to where the December CPI is pointing.