THE LESS YOU THINK ABOUT IT, THE MORE EFFECTIVE IT WOULD BE

EDU DDA Aug. 27, 2024

Summary: With central bank rate cuts about to be unleashed in widespread fashion, here we examine the origins behind them. They aren't what you'd think nor are rate policies themselves. The lack of explanation for their effectiveness is actually the reason why we're supposed to believe they work in the first place. It was this irrational rearrangement which made low rates always previously associated with depression into "stimulus" that to this day is never able to stimulate. And that includes an ongoing experiment delivering more devastating proof that won't matter to the believers.

With rate cuts about to go widespread and then speed up, it’s a fair question to ask, why do so many insist rate cuts are “stimulus?” To begin with, the very notion cuts against all the historical evidence. I’ve recited a fair amount here, on YT, and in presentations, and it isn’t difficult to find. Low rates are only associated with the opposite of stimulated.

Yet, the myth persists regardless and it cannot merely be general ignorance (though that’s definitely a part). Why? The answer is, not joking, Peter Pan. Economics has developed a mythology which cites belief itself as the ability to turn lower rates into “stimulus” and provides as evidence from nothing better than the biggest error in statistics.

Everyone at least slightly familiar with statistics knows that correlation is not causation. The preeminent experts on statistics these days aren’t mathematicians, rather Economists (capital “E”). So, it is odd though painfully obvious why this latter group absolutely demands correlation be enough to prove causation in this one case.

The whole enterprise depends on it.

Our problem begins with moderation. The so-called Great Moderation which began either in the eighties or the nineties depending upon your perspective and it went unexplained for a very long period of time. A key reason why there isn’t a set date or necessarily widespread agreement on the beginning of the period is that throughout the eighties neither Economists nor anyone else was entirely sure the Great Inflation had truly ended.

A huge part of that owes to how little the thing was understood (then or now). Economists claim it was a combination of “loose” monetary policies, fiscal deficits, oil prices, and finally wage expectations. Provided with a laundry-list of such factors, the appearance of one or several immediately puts them back on inflation watch.

Actual money is never even mentioned.

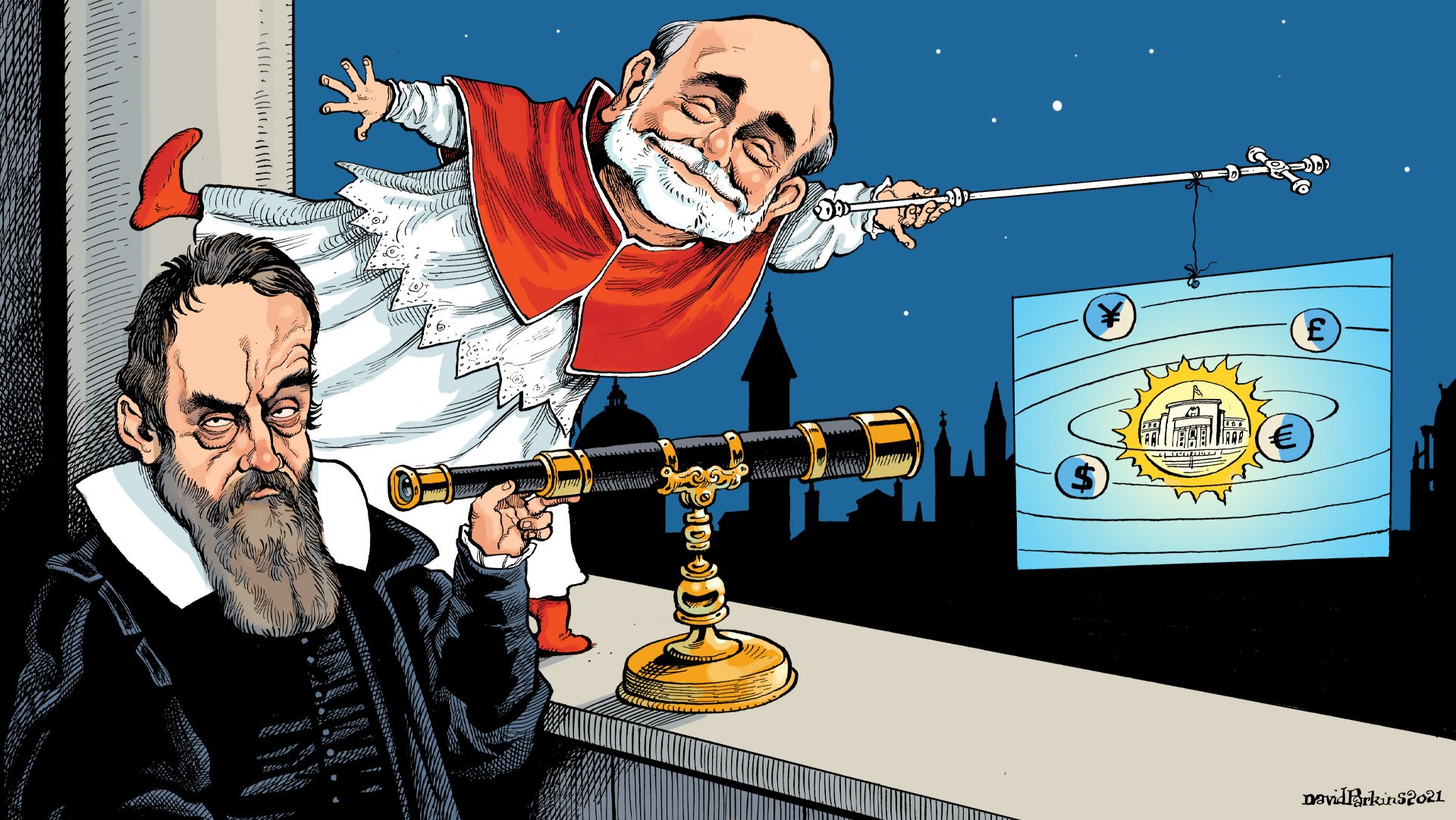

To hear the modern Economist talk about the end of the Great Inflation, it simply conjures images of the ancient stargazer providing the most important advice over the greatest affairs all based on stating correlation of celestial placement as causation for something which took place here in reality. Here is well-known mainstream (Harvard PhD) Economist Gregory Mankiw’s version unintentionally proving this point:

When expected inflation is high, workers demand larger wage increases. Employers acquiesce, expecting that they can pass higher costs on to consumers. As a result, high expected inflation leads to rapid cost escalation, which in turn leads to high actual inflation. Economist Robert Solow put the point succinctly during the high inflation of the 1970s: "Why is our money ever less valuable? Perhaps it is simply that we have inflation because we expect inflation, and we expect inflation because we've had it."

How anyone takes this discipline seriously is beyond my grasp. This is instead why so much time and attention is spent making the discipline appear serious beneath a thick cloak of unnecessarily complicated mathematics. Central banks, which are not true central banks, undertake the same intention, draped thoroughly (to the point of noticeable overkill) in the imprimatur of officialdom and authority. They spend more time making Jay Powell look authoritative than taking real action.

So, if belief is the better part of inflation, then belief in Jay or his predecessors must explain the disinflation boom of the Great Moderation. Back to Mankiw and more tautology:

Just the opposite is true today. Now we have low inflation because we expect low inflation, and we expect low inflation because we've had it. Greenspan has bought for himself a favorable tradeoff between inflation and unemployment by giving the public many years of low inflation.

And how did Greenspan give the Fed many years of low inflation so that they could believe in low inflation? By supposedly getting everyone to believe in low inflation. This is utter madness, yet these people are treated as very serious Economists even if making zero rational sense.

To give you another example from a (very) different part of the same spectrum, here’s the subject of our ATI DDA from a few days ago, Dr. Nouriel Roubini in 2022 when explaining why inflation was about to go wildly out of control for good.

This extended period of low inflation [Great Moderation] is usually explained by central banks’ move to credible inflation-targeting policies after the loose monetary policies of the 1970s, and governments’ adherence to relatively conservative fiscal policies (with meaningful stimulus coming only during recessions).

How did central banks do this? Allegedly in conquering the Great Inflation by using interest rate targets (all news to Paul Volcker at the time). By creating an origin myth for credible inflation targeting, all it would take to keep inflation in check is nothing more complicated than for the top central banker to promise to keep doing it.

They’ll fine-tune the economy moving an interest rate target around, the instrument of credible inflation targeting, as necessary. In this way, high rates historically associated with inflationary periods are now turned into “restraint” through nothing more than Peter Pan.

The more this appears to correspond with good times, then it might as well be the moon passing through Cassiopeia on the zodiac. The latter doesn’t cause anything here on earth, yet neither does Fed interest rate movements yet we are demanded to take those seriously anyway.

Conversely, then, low rates which had always signaled depressionary times don’t any longer because we believe in credible inflation targeting which says low rates are stimulus just as high rates are suddenly turned into constraints. Rates are just what we’re told they are, unanchored by any set of reality.

Economists offer their tautologies to explain it, proving “proof” only in the appearance of the Great Moderation itself. Absent another explanation, what else could it be? What we have are only two coincident facts: the Fed turned to inflation targeting and interest rate targeting out of necessity and it did so during a period characterized by low levels of consumer price gains and unusually infrequent recessions most of all completely undisturbed by the worst monetary breakdowns causing deflation and depression.

It was the latter characteristic which gave the central bank evolution its whiff of credibility even as it makes absolutely no sense as to how belief-based policy wielding upside-down interest rates could possibly have freed the world from the various intermittent monetary panics of the past. That’s the potency of belief; the less you think about it the more effective it would be.

This statement is exactly what should be affixed to the front of the Eccles Building in DC and everywhere else the Federal Reserve operates.

Milton Friedman actually explains this for us very well as nothing new. In every era, central bankers take credit for the good times claiming whatever it is they did during them were the reason the times were so good, demanding correlation be treated as inarguable causation every single time. This is the true “printing press” of any modern central bank; it is Peter Pan since not enough of the public has ever been informed of these otherwise obvious nuances.

In years of prosperity, monetary policy is said to be a potent instrument, the skillful handling of which deserves credit for the favorable course of events; in years of adversity, monetary policy is said to have little leeway but is largely the consequence of other forces, and it was only the skillful handling of the exceedingly limited powers available that prevented conditions from being even worse.

Here we see instead the contra-proof. That is, the Fed says interest rate targeting as the necessary implement of credible inflation targeting policies is responsible for the Great Moderation and whatever genuinely good times which came with it, so the reverse must also be true to have any claim on evidence. These policies would have been tested during bad times and come out just as clean and effective if there is anything to it.

Obviously, no, as Friedman had already spoiled. We’re supposed to believe rates were wildly successful 1992 (thereabouts) to 2007, then totally out of the blue the monetary disaster previously missing shows up and now all of a sudden rates are powerless to do anything about it. Worse, rates go lower and stay there during the 2010s, a time when even Economists have had to admit the economic system worldwide changed – and not for the better – but this time, in this prolonged case it couldn’t have had anything to do with interest rate policies?

Mankiw needs a séance with Solow to come up with another tautology.

The evidence continues to pile up and all over the world. Whatever Economists might still say about the Great Moderation the inverse does not hold either in the various recessions which happened during then or today in any case.

To that end, the Chinese are undertaking more and extended testing providing conclusive evidence in real-world practice. Authorities there have been cutting rates for a decade! It began all the way back in November 2014:

China finally admitted it has a growth problem — and that is a big step to getting the global economy back on track.

For months, Beijing avoided broad stimulus measures, signaling that it was comfortable with the country’s slowing growth. But China’s pockets of weakness, coupled with the continuing woes in Japan and Europe, prompted anxiety in the financial markets.

Now China is changing its stimulus stance, announcing a surprise interest rate cut on Friday. The action will lift the country’s flagging housing market and large state-owned companies, as well as bolster other nations that have come to rely on those core parts of China’s economy.

As to the latter, it didn’t. The 2014-16 period (Euro$ #3) was an epic disaster for much of the emerging world, so much so most of it has yet to recover. And that includes China, even if it managed to put off that reckoning a few more years by its pursuit of more real estate bubble (not interest rate cuts) in 2016. Even that didn’t last long.

IN EVERY CASE NOT JUST HERE WITH CHINA, RATE CUTS FOLLOW ECONOMIC GROWTH DOWNWARD; THEY ARE CORRELATED, TOO, WHEN THEY SHOULD BE THE CAUSE OF DOWNTURNS REVERSING

Going back to 2014, Chinese rates have only been lowered ever since. During that period, there has only been a single instance when the economy there could honestly be said to have been stable and that was 2017. It wasn’t rate cuts or even the restarted real estate bubble, instead a reflationary zone in between eurodollar flareups.

Once Euro$ #4 showed up toward the end of that year and more strenuously at the start of 2018, more slowing in the economy was accompanied by more rate cuts rather than rate causing that slowdown to reverse as they should have if they were true causation – proving again what Friedman said, that correlation is causation only when it suits Economists and central bankers.

The experiment in China has, of course, continued right up to the present day. There have been multiple rate cuts over the past few years which haven’t done anything to arrest the economic decline, having absolutely no effect on credit or banks whatsoever. Peter Pan doesn’t seem to help even though many Chinese people really believe in the PBOC (as if they have a choice).

Importantly, China’s bond market sure doesn’t which is why the PBOC is cracking down on…low interest rates. You really can’t make this stuff up. If you simply believe rates are whatever authorities say they are, then it will just work out grand!

It was the Great Moderation which birthed this insidious idea that interest rates are somehow backward and all-powerful at the same time when before around the early nineties no one had ever really thought so. Just to finish with another historical example, here’s The New York Times describing expectations surrounding the growing inflation dilemma Mr. Greenspan was facing in 1988 in the first year of his tenure.

There is more truth in these following nine words than anything written since the “maestro” was ridiculously given his moniker:

Monetary policy by itself cannot prevent inflation or recession.

Unless you really want it to?

Volcker didn’t conquer inflation, the Fed just needed a story to sell correlation.

Low interest rates are never good. Period. Low rates are not the cause of anything, they are instead the symptom forever associated with bad times because bad times demand safety and liquidity – just as what’s grabbed hold of Chinese, American, European, even Japanese bonds in 2024.

We expect lowering interest rates to fail not because of what we might believe of them, but due to the fact they are caused by the very failure they correlate strongly with it. Economics is not a serious discipline yet it is treated as such only because to this day no one really knows what happened between 1982 and 2007, and fewer people still understand what truly went on from 2007 and afterward.

There was tons of rate cutting yet Peter Pan like the economy remained grounded. Will correlation finally fail in 2024? Actually, no, simply because there is no cause to believe it could.

BEFORE THE GREAT MODERATION, THE FED WAS CONSIDERED A JOKE BECAUSE ITS HISTORY DEMAND IT BE TREATED AS ONE. THE IDEA OF A COMPETENT INSTITUTION IS A RELATIVELY RECENT INVENTION INTENTIONALLY MADE TO TAKE ADVANTAGE OF, YES, CORRELATION.

THERE WOULD BE THIRTEEN MORE YEARS OF THE GREAT INFLATION.