GASOIL AND MORE RECORD SWAPS

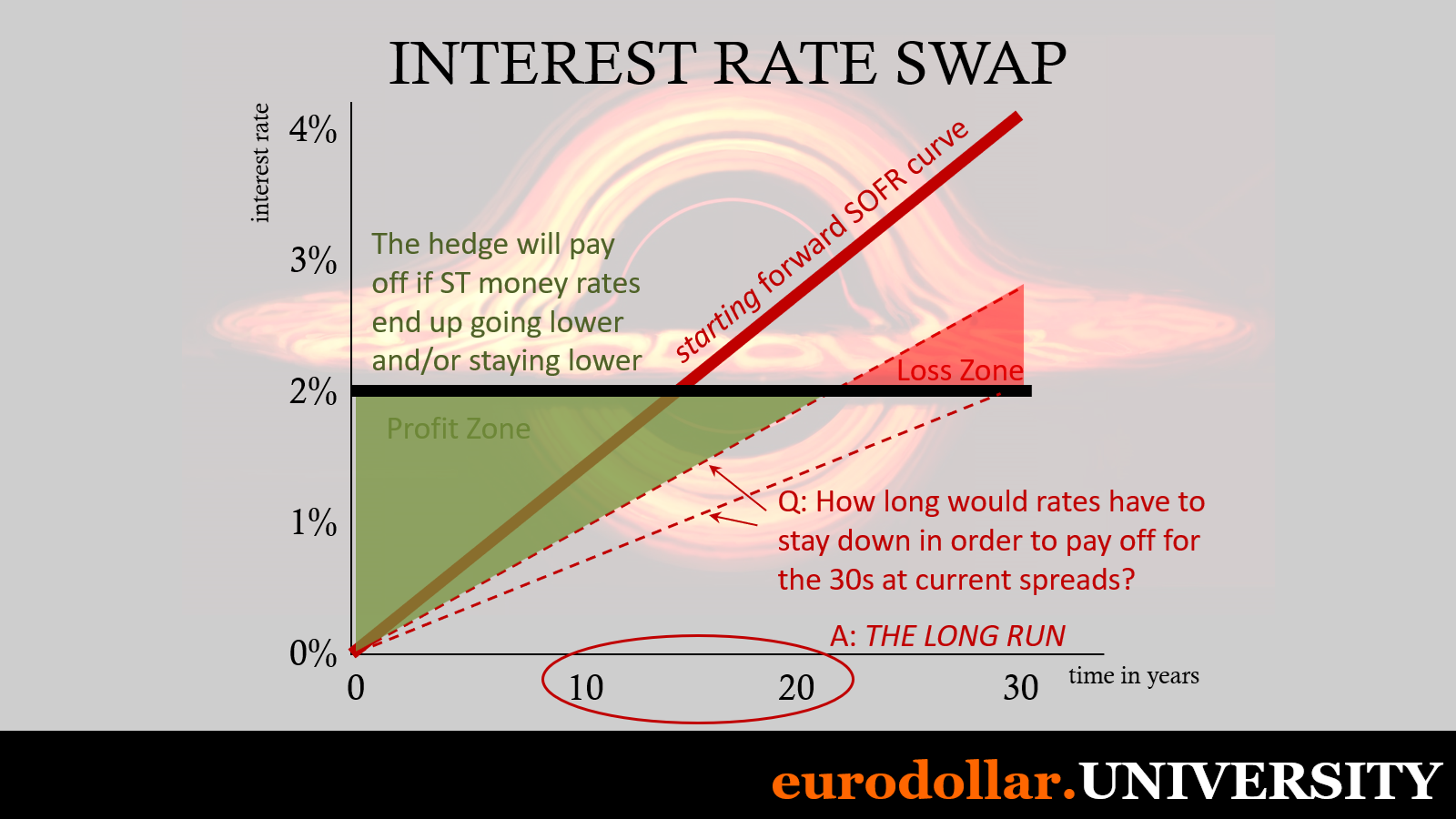

Summary: While everyone has been watching US labor data and now fixated on the election, there have been some major developments. Energy markets are bracing for a supply surplus in the world’s most critical fuel. And swap spreads absolutely plunged throughout last week’s critical macro gauntlet and up through yesterday. All three major maturities including the 5-year for the first time set more record negatives.

A MUCH BIGGER CHALLENGE THIS TIME

Summary: With the election quickly settled, attention now naturally turns to the biggest question facing the incoming administration: can Trump pull it off? However anyone might judge the first term, this second one facing even greater challenges. Making the comparisons you can easily see the difference. The new President and his government will definitely have its work cut out for it. Hopefully, Trump will look back on 2016 for the one thing that could really help this time around facing an entirely different cyclical environment.

XI’S BAD BET AND BAD BANK MATH

Summary: China began the month with some mild good news on its housing condition. It hasn’t been able to follow that up, however, with the latest credit data again majorly underperforming. That, plus the slow response on the bank plan from authorities, brings up the possibility of the credit and balance sheet math being against them. Not quite insurmountable, just far more difficult and time-consuming than may are hoping for.

GOLD PLUGS PARADIGMS

Summary: Stocks and gold have been on an incredible run, though mostly just coincidence. Only one of them has fundamental purposes and it is critical to get those right. To understand that significance, we have to detour back to the Great Collapse and the Crash of ‘29 to untangle misconceptions about gold, money, banks, and equities. The missing perspective is the blackhole. Bullion is hedged for the next one to come along, whenever it might and whatever it might be.

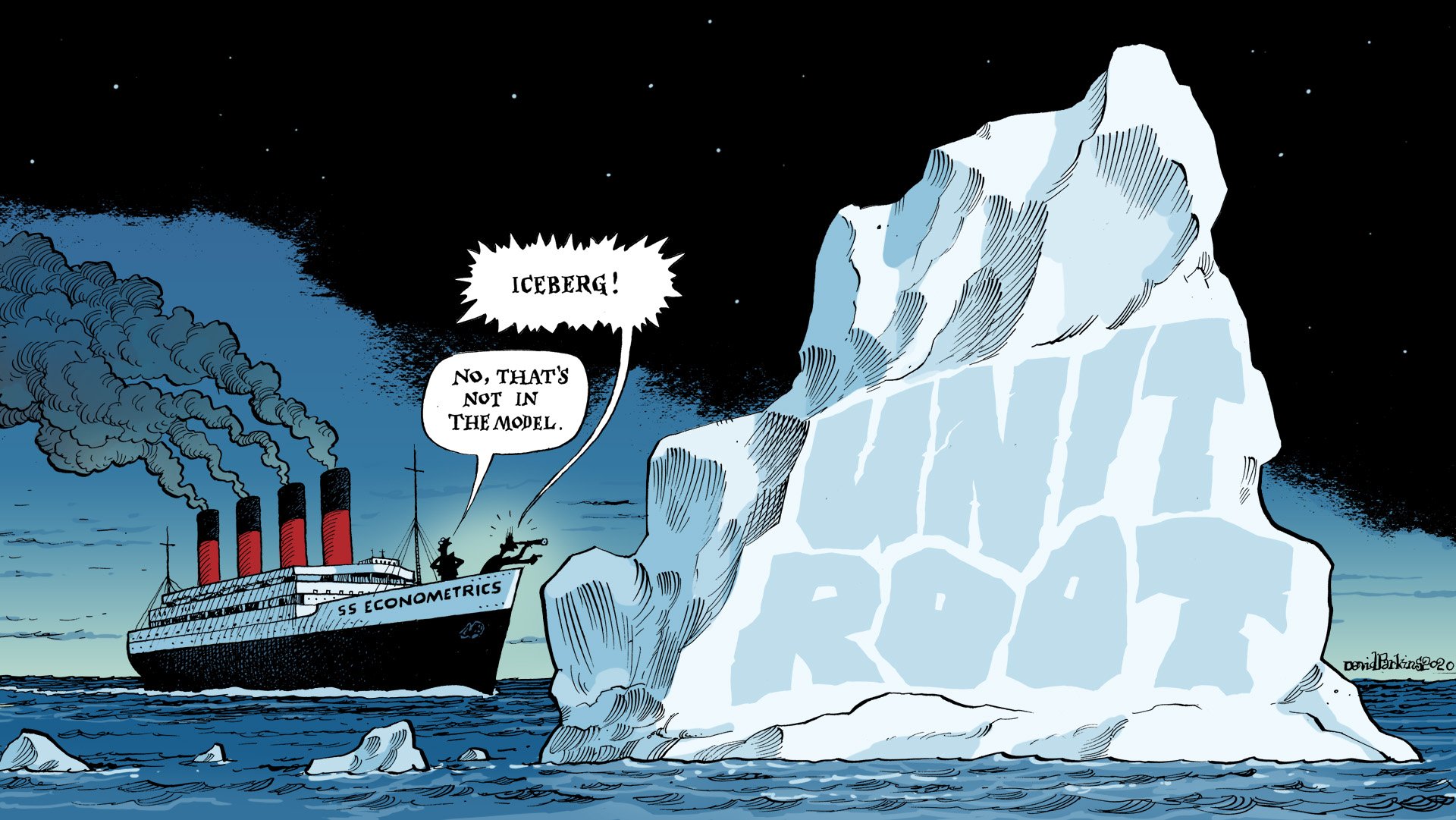

THE ROOTS OF MORE UNITS

Summary: A bunch of Q3 GDP data, including the US. Germany’s has displayed a plainly unnatural oscillation that opens the door to a much wider and more profound set of questions. Are their unit roots? If so, could these lead to difficulties in data masking the consequences in the real economy? The evidence does point in that direction with each major and minor revisions. Conclusively proof is elusive primarily because these series would be that proof.

HALLOWEEN BILLS FEAR JOBS

Summary: Suddenly the 4-week bill yield crashes by 11 bps today. Why? To figure that out, we have a look at more repo fails plus journey across the Pacific to see what the Japanese are up to. Not the BoJ, though the central bank does provide a useful contrast to this review. There are bills on both sides plus term-SOFR. In the end, however, the 4w bill today might be a bet on not just a bad October payroll report, it could be even more consequential than that.

USE FOR TERM PREMIUMS

Summary: Term premiums are now positive and rising. This means something very different to academics than the other side of term premiums. That opposite side is all fundamentals. The story of and behind term premiums and why academics turn to them so often exposes a lot more than they realize. It isn’t the risks they associate, rather a clear dishonesty and desire to obscure the most inconvenient set of truths in everything.

PARADOX OF FISCAL DOMINANCE

Summary: Copper to gold hits another new low. Swap spreads set records. Crude oil crashes again. Why aren’t these markets buying at least the China stimulus? For one thing, the idea of “stimulus” has been so thoroughly tested there is no reason to. Anyone claiming “fiscal dominance” is inflationary aren’t seeing these deflation signals or why that is. The evidence is unusually clear and conclusive. What’s missing is only unambiguous proof “stimulus” in addition to be ineffective is actually harmful.

CARRY COLLATERAL SWAP IN J-BILLS

Summary: Repo fails are up again in the latest week, continuing their rising trend which dates back to early August. The events back then were closely tied to Japan’s carry trade. We have even more powerful evidence pointing to this from the Japanese perspective: three-month J-bills. Those rates are behaving in a way we’ve seen numerous times before and, more importantly, like fails they’re still doing it here toward the end of October.

WHAT’S IN A (THE) DOLLAR?

Summary: Why doesn’t anyone monitor money? The short but truthful answer is practically no one really knows where to begin. How can this possibly be? The recent misadventure of White House Economics advisor Jared Bernstein is actually a good illustration of where the current state of knowledge stands. Surprising to most, Bernstein was far closer to the truth than any mainstream Economists or the throngs on social media who mocked him. We’ve got Minsky, Friedman base money, ghosts, MMT and, of course, the eurodollar perspective.

WE DON’T NEED ANOTHER BEVERIDGE

Summary: Evidence for the final stage of recession continues to pile up and in a variety of formats; that just makes the possibility all the more compelling. Another retail giant basically admitted consumers have changed because of unemployment prospects, though, as always, careful not to use that specific term. Doesn’t matter because that’s the way all the data keeps pointing, including the one curve which puts together the two friendliest data series on labor and still comes up with that final case.

THIN AIR ELASTICITY

Summary: Rather than merely review the deluge of macro data from today, it’s worth instead revisiting the topic of money elasticity. Since we're coming up on September, we'll focus on the downside or deflationary side of elasticity. It wrongly gets lumped together with bailouts, though it is understandable why that often is. Aside from it being wrong, though, history is absolutely conclusive on the matter - including the one time we all lived through.

EVERYONE LOVED THE FAKE RATE CUTS, TOO

Summary: We're finally on the cusp of rate cuts, therefore rate cut mania. This unqualified acceptance of interest rate policies is downright irrational. Not only is there overwhelming evidence against it, we even have a case where the rate cuts themselves were inarguable FAKE. Yet, sadly, predictably, they were widely hailed as if the naked emperor has been finely appointed by the most skilled tradesmen. He is; only their trade isn't tailoring.

POWELL SAYS IT’S OK HE WAS WRONG ABOUT EVERYTHING

Summary: Jay Powell at Jackson Hole, Wyoming, today turned out a speech unlike any other he has given before. That said, it wasn't actually something new either from a Fed chair or one in that same setting. Like Ben Bernanke a long time before, Powell started out by admitting the US is in serious trouble before then trying to sell the world he has a way to fix this. Sadly, it's also the same one Bernanke tried to sell.

THE REAL SIDE OF GDP

Summary: Summary: The US Treasury market continues its aggressive bull steepening, with more parts of the yield curve un-inverting including the 2-year/10-year spread for the first time. At the same time, the US govt reported an even better second quarter GDP estimate. How can we reconcile these two very different signals? Easy: use GDP's opposite side. Unlike the more famous version, the other one is flashing all the same warning signals as Treasuries, the unemployment rate, even overseas economies.

AGGREGATE MALINVESTMENT

Summary: Given the mainstream description of economic circumstances especially in the United State the past few years, the idea of the entire financial world hedging to be prepared for more depression economics seems beyond far-fetched. It at first appears downright preposterous. Yet, the full weight of evidence is on the markets’ side. All that’s really left is to rewrite the narrative which actually fits the facts.

SCIENCE FICTION OVER DIM SUM

Summary: China’s PBOC came out with a surprise rate cut to begin this week because the government’s Third Plenum went over like a lead balloon. The real story behind it is a troubled power attempting to do what no other socialist system has ever been able to, all because the monetary challenge was too big for them to tackle. This is a measure of the degree of difficulty for China and simultaneously a commentary on what the whole world is facing.

A CRITICAL START SIGNAL IN THE MIDDLE

Summary: Over the last couple of weeks, the UST yield curve’s 5-year to 10-year spread has un-inverted and steepened. This is potentially a critical first step signaling the wider trend for the marketplace though also just as importantly the economy. Unfortunately, it isn’t so easy and simple. Here we’ll review the developments and some historical cases to see what we can make of all this.

TOO MUCH DISINFLATION

Summary: The June 2024 CPI data didn’t just produce solid disinflation, it actually showed an alarming amount. For the second straight month, the core CPI dipped sharply and in a way we’ve rarely seen before. It doesn’t matter it wasn’t negative, it has clearly been pushed outside of its usual range and pattern. Examining its history especially during the worst recessions shows just how unusual and what it must take to create these abrupt and sharp changes to price conditions. The fact these are perfectly consistent with everything we’ve been getting only makes a strongly compelling case even more so.

THE GREATEST SUPERSTITION

Summary: We are now at the stage where we can finally talk about superstition. In other words, Fed rate cuts. Why does everyone believe these have magic powers? Economic study (small “e”) almost never gives us a clear, unambiguous result, but when it comes to central bank rate policies at these times it actually does. The evidence leaves no room even for interpretation. With rate cuts on the way, let’s examine both the evidence and the rationale no matter how irrational.