THE FREEZING ECONOMY’S HOT CPI

Summary: At first, these seem like contradictions: a “red hot” CPI at the same time one of the world’s oil giant’s reports laying off one-fifth of its entire workforce. After all, the latter is in response to the realities of oil and gas prices and margins which are main inputs into consumer price measures. Reconciling these two outcomes is not all that difficult once you realize it isn’t a hot CPI so much as a heated interpretation of it, one free from legit economics. It is economics (small “e”) which helps us explain a lot, including the danger of the Beveridge Curve represented by all these things.

JUST CALL IT STEEPENING

Summary: Payrolls were ugly in October and that wasn’t the only problem nor the worst part. Despite what sure looks like recession in the jobs market, the long end of the yield curve keeps selling off, rates rising when it seems like they should be doing just the opposite. The short end is, with bill rates more aggressively going lower as, at the very least, the next set of Fed rate cuts is basically locked in at this point. How, then, do we explain this odd curve divergence? The answer is that there is nothing odd about this at all.

SENTIMENTAL PARALYSIS

Summary: The FOMC announcement went as everyone expected. It was the language used in conveying the statement which caused some commotion. For his part, Chair Powell made things clearer by offering to clear up nothing. Officials have no idea what to think on the economy, particularly prospects for trade wars. That’s more than curious because policymakers have an enormous volume of scholarship on the subject from which to form solid opinions. Still, they refuse. Why?

OKUN NEEDS A BEVERIDGE

Summary: November JOLTS was grim, everything beside job openings which, not surprisingly, everyone focused exclusively on. Hires way down, quits at a new low, layoffs on the rise. Worst of all, where the current JOLTS - including job openings - fits on the Beveridge Curve. This isn’t just an academic matter, the concept behind it will decide the biggest question of them all: where on the curve indicates which way the long run economic potential is most likely to be.

JUST CALL ME TROUBLE

Summary: We have to question what the recession question even is before then asking the only question that gets to the root of the matter. First, the December CPI and an update from China with more money market turmoil. Afterward, getting to that potential unit question starting with Germany’s latest update then reviewing the history of “technical recession.” What we might call not-recovering is of secondary importance, at best, since what Germany shows is that whatever the labor it is indeed happening.

COME ON NAIRU

Summary: Why can’t Jay Powell and the FOMC seem to get a fix on “inflation.” Their entire recent hawkish stance is built on a single theory with an atrocious track record - even in Powell’s own experience. Today’s payroll report came in “hot”, yet, in truth, the labor market is under significant stress which is ironically illuminated by the very way in which the Fed considers it potentially inflationary. This whole discussion explains exactly why central bankers are doing what they’re doing, unable to make a determination on “inflation” pressures. Or labor strength. What’s the right comparison to make?

ABRUPT PAIR FOR S. KOREA

Summary: Just over an hour ago, the Bank of South Korea voted to reduce its policy rate for the second straight time, unexpected because of how rare this has been for BoK. All that does is underscore just how weak the economy there has become. Why? Globally synchronized. Yesterday, the FOMC released its minutes which were predicably conflicted. What South Korea just did - and why - should put any conflicts to rest at least for the rest of the world outside Fed policymakers. Even so, those at the FOMC do appear to realize just how precarious the position really is.

EUROPE ABOUT TO CUT RATES FASTER AND FARTHER

Summary: The Chinese did, indeed, cut rates - a lot of them and by a lot. Aside from that panicky confirmation, we turn our attention to Europe where various curves continue taking substantial twists. Interpreting them means considering possibilities only now being admitted by either central bankers or mainstream sources. Not just some macro, layoffs risk. Looking behind the last European rate cut also introduces something else.

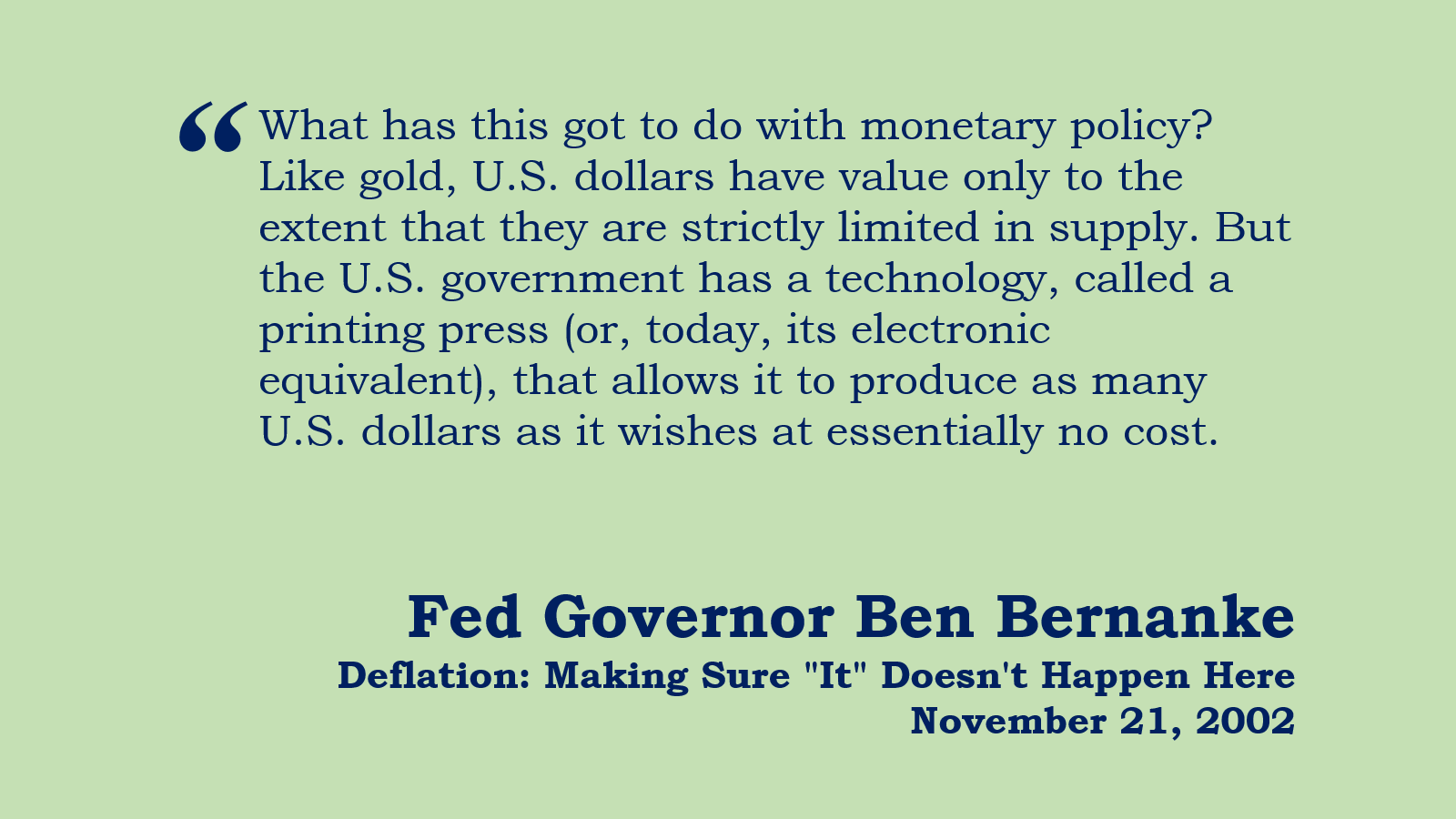

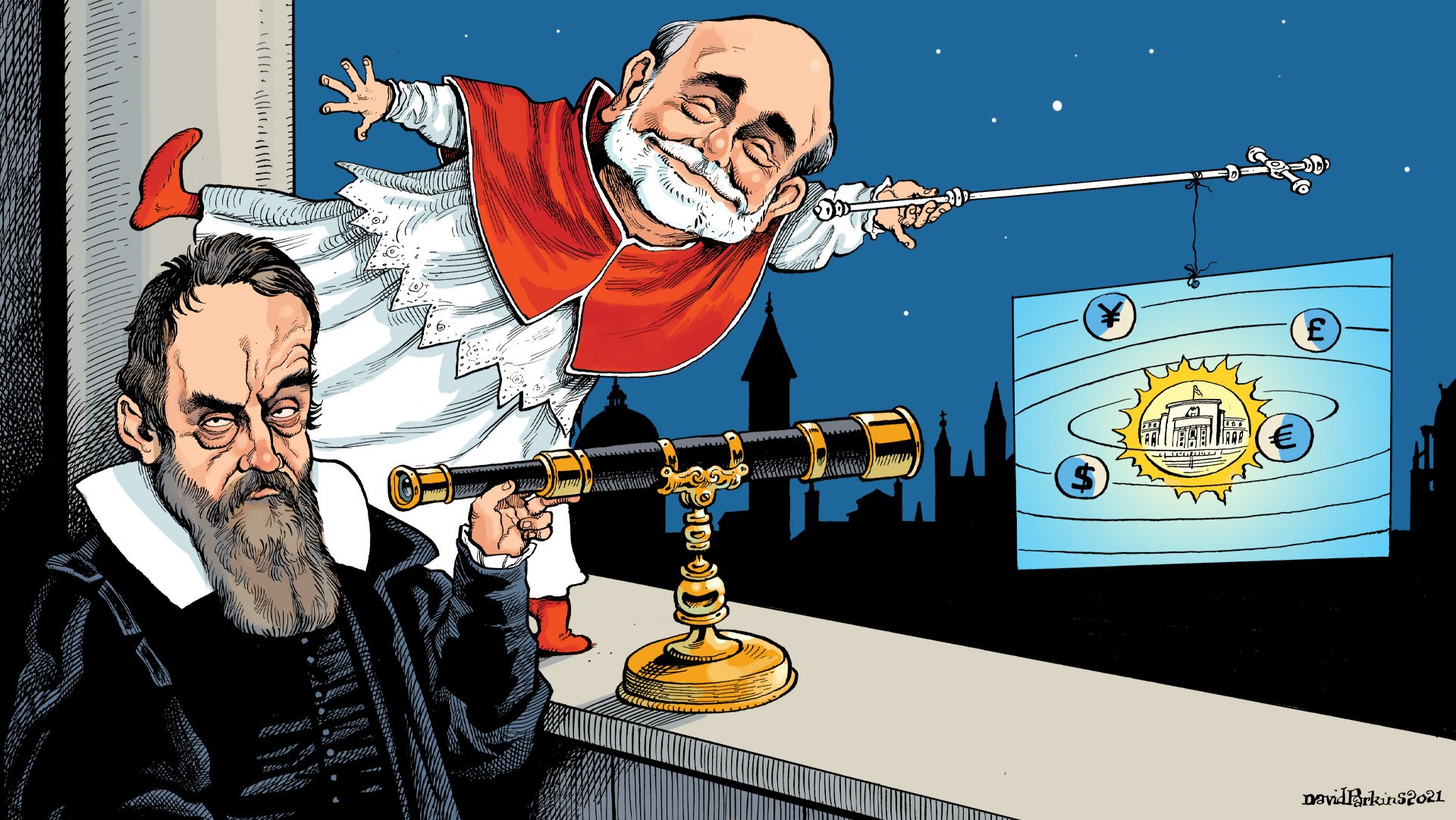

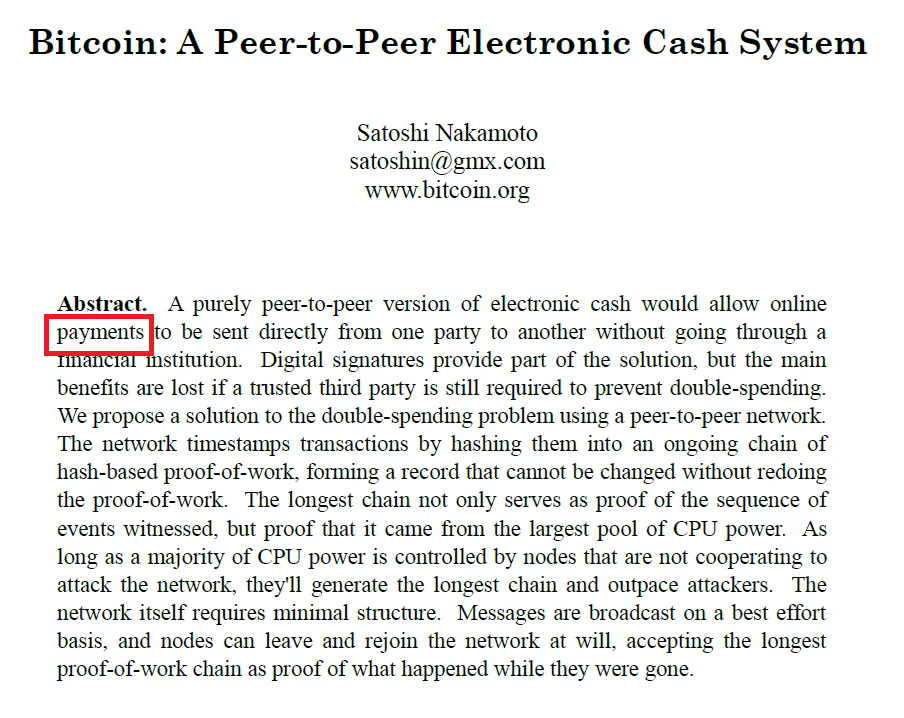

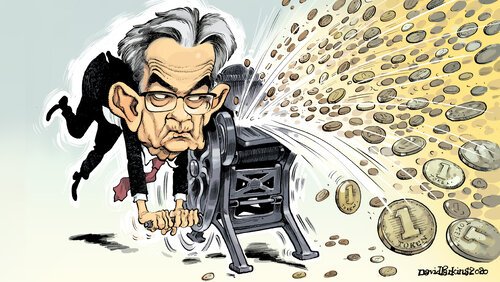

‘SCIENCE’ OF RATE CUTS

Summary: This week is off to an auspicious start, rate cut hysteria in full bloom. Setting aside the ultimately irrelevant matter of fifty vs. twenty-five, what is a rate cut supposed to be? It sounds like a stupid question - the Fed lowers interest rates. Which one or ones? What, exactly, does that do? How is this supposed to work? No one ever thinks too much on it which is precisely the purpose. Here we'll answer those questions using their own words and studies, starting with Mr. Bernanke.

THE LESS YOU THINK ABOUT IT, THE MORE EFFECTIVE IT WOULD BE

Summary: With central bank rate cuts about to be unleashed in widespread fashion, here we examine the origins behind them. They aren't what you'd think nor are rate policies themselves. The lack of explanation for their effectiveness is actually the reason why we're supposed to believe they work in the first place. It was this irrational rearrangement which made low rates always previously associated with depression into "stimulus" that to this day is never able to stimulate. And that includes an ongoing experiment delivering more devastating proof that won't matter to the believers.

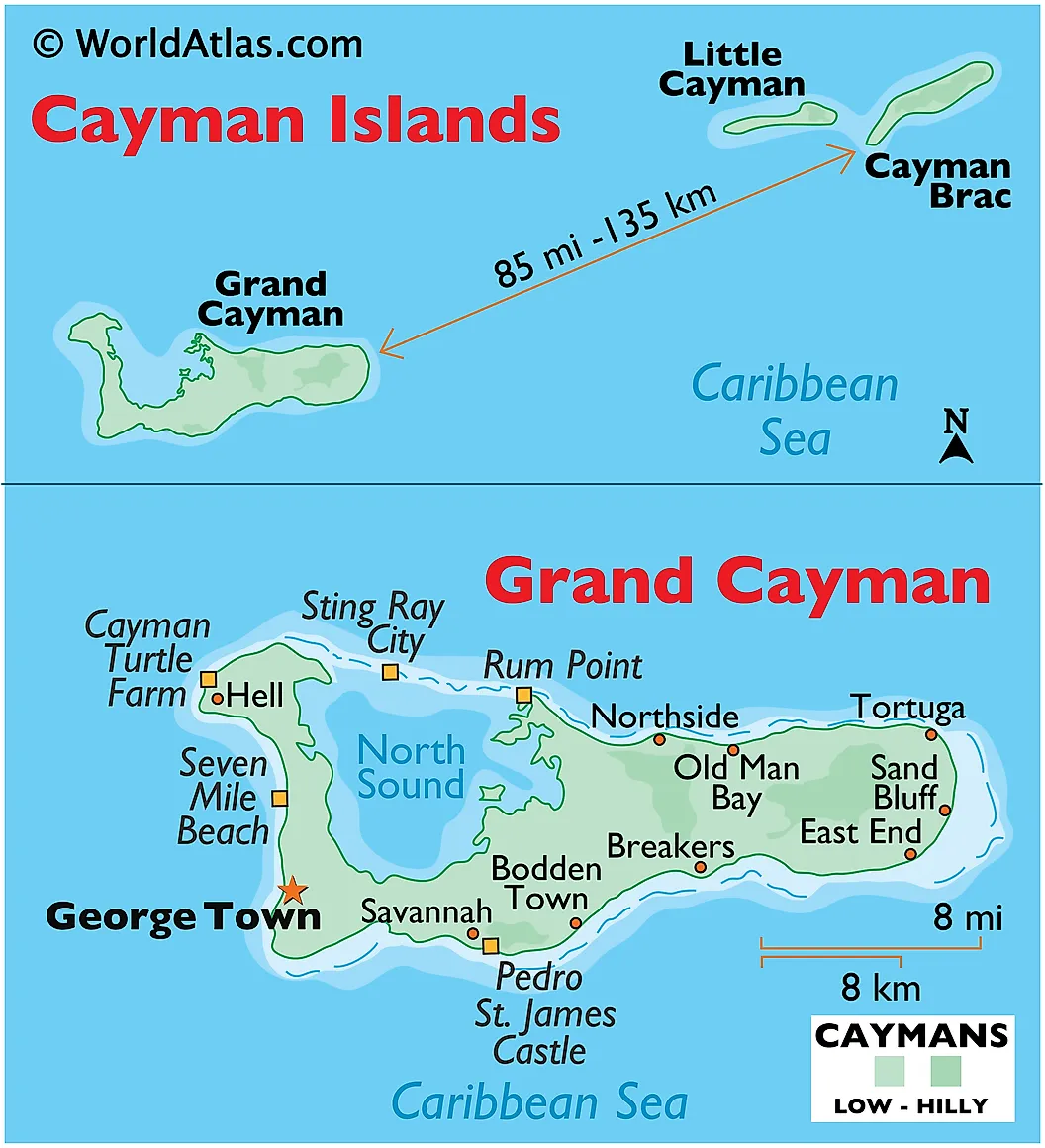

A CAYMAN JAPAN CONNECTION MADE IN EUROPEANS’ US BRANCHES

Summary: Repo fails were lower for the second straight week. That means we can check the correlations with other indications like bills, Treasury and Japanese, going in the other direction. Maybe more importantly, TIC figures show a massive deposit of USTs in the Cayman Islands. When? July, August, and September, the very period in question. The question for today’s DDA is how to connect all these pieces. We do just that with a big assist from…the ECB.

A NEW GRESHAM FOR OLD MONEY

Summary: There will not be a BRICS currency. And that’s first assuming any of its members want one (spoiler: they don’t). Contrary to every mainstream belief, money is not a government matter. It is instead driven entirely by commercial, free market interests. We have centuries of development and evolution which stand as an unchallenged testament. The whole thing comes down to one single factor, a modern “Gresham’s Law” which explains the entire way the world, not just the monetary world, really works - has for centuries.

WHAT IF THERE IS NO RESERVE ANY LONGER?

Summary: Dollar doom-ism is everywhere even though those allegedly on the wrong side of it are complaining about something VERY different. The BRICS, for example, are right now struggling mightily with currencies. Those have nothing to do with money printing and a falling dollar. From rupee to real, they are hitting record lows. The dollar “bull” is being unleashed on the world to the point nations are purposefully trying to avoid the reserve currency system not replace it. That’s a far more profound result than just a global recession question because it means we already don’t really have a reserve currency any longer.

WHAT DOESN’T HAPPEN CAN KILL (ECONOMY)

Summary: It’s not just that JOLTS hiring was weak again, very nearly matching June’s shocking low, the consequences of that are piling up again in all-too familiar ways. The reason why the economy never recovered from 2008 was the lack of hiring following the crisis. We had already seen that once before in the 21st century, following the dot-com recession. The hiring rate here in 2024 is already worse than that time, around the same as coming out of the 2010s.

WHY TWO AND NOT NONE?

Summary: The question everyone should be asking after yesterday’s Fed debacle isn’t about “hawkishness” at all. The real issue is why officials didn’t say the labor market was entirely out of the woods. In fact, we know from the dots as well as Powell’s statements no matter how much they’d like to declare a soft landing they know only too well they really can’t. The labor data is still coming up the wrong way, including several metrics and perspectives even inflation-ist officials are having a really hard time setting aside.

DO WE REALLY NEED THE BANK OF CANADA?

Summary: Canada’s CPI becomes the latest to drop into the “undershoot” category raising the dangers of becoming the “bad” kind of disinflation. Economists in the country are already calling for a more aggressive response. But who should it be who does respond? This sounds like an absurd question since Canada’s weakness is the Bank of Canada’s territory. The evidence instead importantly shows it doesn’t matter what the BoC does. On the contrary, bad disinflation in Canada is actually everyone’s problem.

A PAIR WITH SOX AND FRANCE

Summary: It’s always dangerous to wade too far into equities looking for useful macro or money signals. There is far too much noise in share especially indexes. However, at certain times substantial and critical divergences invite some careful scrutiny. We have those here with two of them, a curious pair each with compelling stories. The one a big-cap index, the other related to a widely-recognized cyclical industry. And both breakdown coincident to a number of other real economy developments.